Quick Take

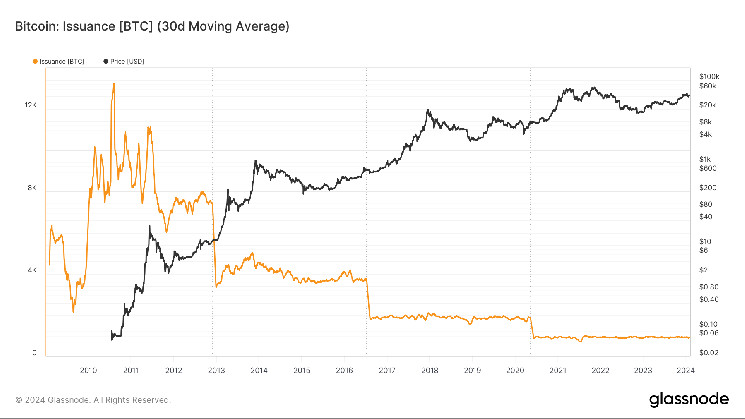

The imminent halving event for Bitcoin in April 2024 will slash monthly issuance from 27,000 BTC to approximately 13,500 BTC and bring daily rewards down from 900 to 450 BTC, giving Bitcoin an inflation rate of less than 1%.

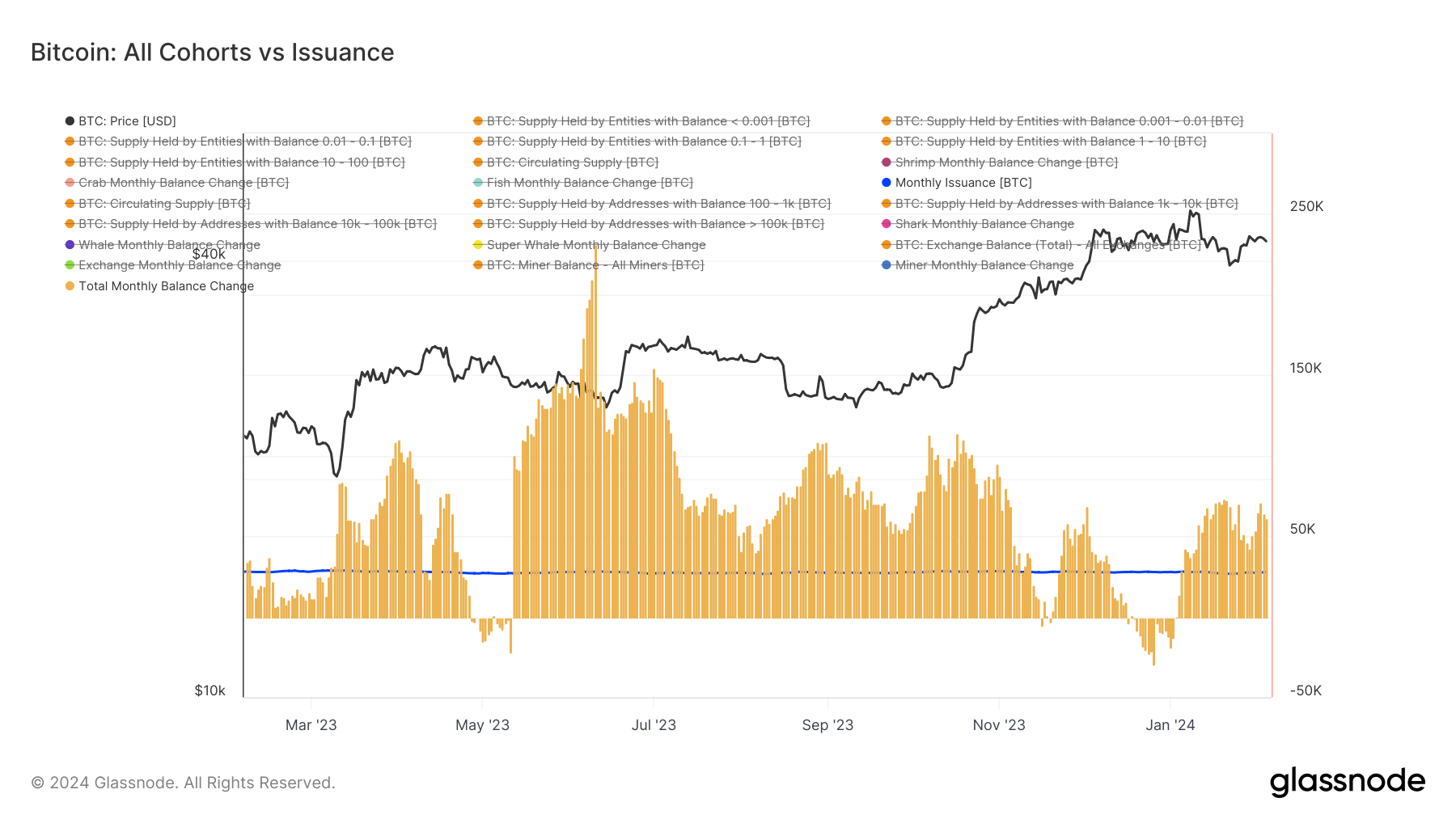

Detailed analysis of individual cohorts illustrates the unique accumulation and distribution patterns within the Bitcoin market. Over the past 30 days, smaller players, known as ‘Shrimps,’ holding less than one Bitcoin, have added 19,500 BTC to their collective pool.

Conversely, ‘Crabs’ (holders of 1-10 Bitcoin), ‘Fish’ (holders of 10-100 BTC), and ‘Sharks’ (holders of 100-1000 BTC) have been distributing their holdings, with a significant outflow of 150,000 BTC from the Sharks cohort.

This shift contrasts sharply with the behavior of ‘Whales’ and ‘Super Whales’, who, holding more than 1,000 and 10,000 BTC respectively, have been net accumulators, adding 126,000 and 83,000 BTC to their balances.

This accumulation by heavier players may have ties to the activity of Bitcoin ETFs, such as Grayscale, which often holds Bitcoin in multiple wallet addresses.

Meanwhile, a net inflow onto exchanges and a slight drop in the miners’ net balance signifies increasing selling pressure.

Collectively, all Bitcoin market cohorts are displaying a net accumulation of around 61,000 BTC. Remarkably, this figure represents more than four times the monthly issuance following the imminent halving event. Should this demand persist in the face of reduced supply, it could potentially exert upward pressure on Bitcoin’s price performance.