Bitcoin (BTC) is striving to sustain its gains above the $50,000 mark as the maiden cryptocurrency seeks a new all-time high.

While a substantial portion of the market anticipates Bitcoin to continue its bullish momentum, supported by catalysts such as the upcoming halving, another segment believes that the leading crypto is on the verge of a potential crash in the coming days.

In particular, crypto analyst Alan Santana, in a TradingView post on February 16, suggested that Bitcoin is teetering on the edge of a significant decline following its recent valuation of $52,000, possibly marking a temporary peak.

The analysis centered around identifying a higher high in Bitcoin’s recent performance, amplifying a pronounced bearish divergence with the daily Relative Strength Index (RSI).

According to Santana, the session high on February 15 concluded with a Doji, a candlestick pattern indicating indecision, followed by a bearish start to the February 16 trading session.

Emphasizing the overextended nature of the current wave, Santana predicted that the next drop is imminent and would be characterized by its speed, suddenness, and strength. In his view, Bitcoin is likely to retest the $35,000 level.

“The middle of the range sits around $35,000… The next support level has been confirmed within the $34,000 to $36,000 price range. <…> Since the current wave is already overextended, we can expect the next drop to show up anytime now, fast, sudden and strong,” he said.

Bitcoin seeks to hold the $50,000 mark

The gloomy outlook emerged as Bitcoin retested the $52,000 mark, successfully regaining the coveted $1 trillion market capitalization. These gains follow a week where Bitcoin resiliently bounced back from a dip below $50,000, triggered by hotter-than-expected U.S. inflation data, ultimately reclaiming this psychologically significant price level.

The recent surge in Bitcoin’s value is attributed to a heightened influx into BTC spot exchange-traded funds (ETFs), with analysts foreseeing increased flows throughout the year.

Standard Chartered analysts, for instance, projected that spot ETFs could attract between $50 billion to $100 billion in investments this year alone.

Additionally, the market is closely monitoring seven pending applications before the U.S. SEC to approve a spot Ethereum (ETH) ETF. The SEC is expected to make final decisions on several of these proposals by May.

At the same time, the upcoming Bitcoin halving scheduled for April is historically seen as a bullish catalyst for the leading cryptocurrency.

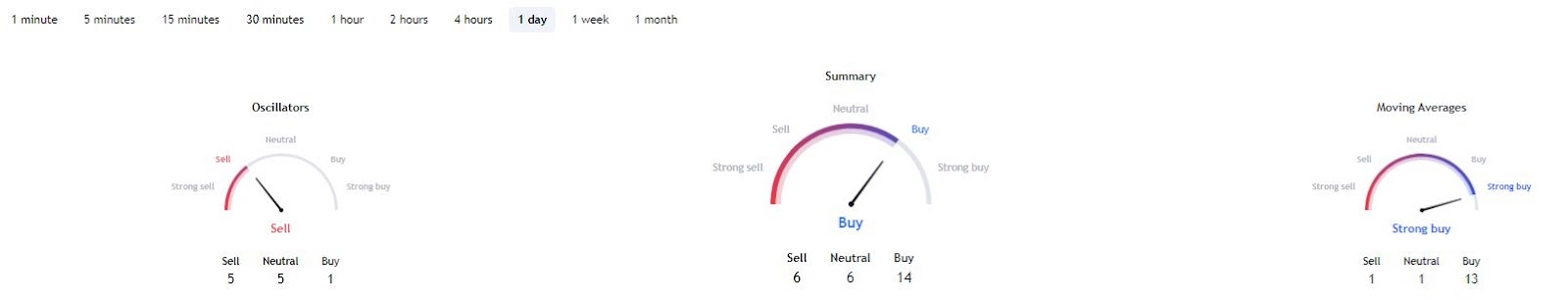

Bitcoin price analysis

By press time, Bitcoin was valued at $51,683, reflecting daily losses of less than 1%. The leading cryptocurrency has experienced a nearly 10% increase in the past seven days.

Additionally, technical indicators for Bitcoin are signaling bullish sentiments. A one-day sentiment summary from TradingView aligns with a ‘buy’ sentiment at 14, and moving averages indicate a ‘strong buy’ at 13. Meanwhile, oscillators are indicating a ‘sell’ at 5.

Overall, the prospects of Bitcoin will also largely depend on other general economic factors, such as the interest rate decisions from various central banks.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.