The decentralized finance (DeFi) ecosystem is full of opportunities and risks that could reward savvy cryptocurrency investors. For example, lending stablecoins can yield up to 20% in liquidity mining protocols.

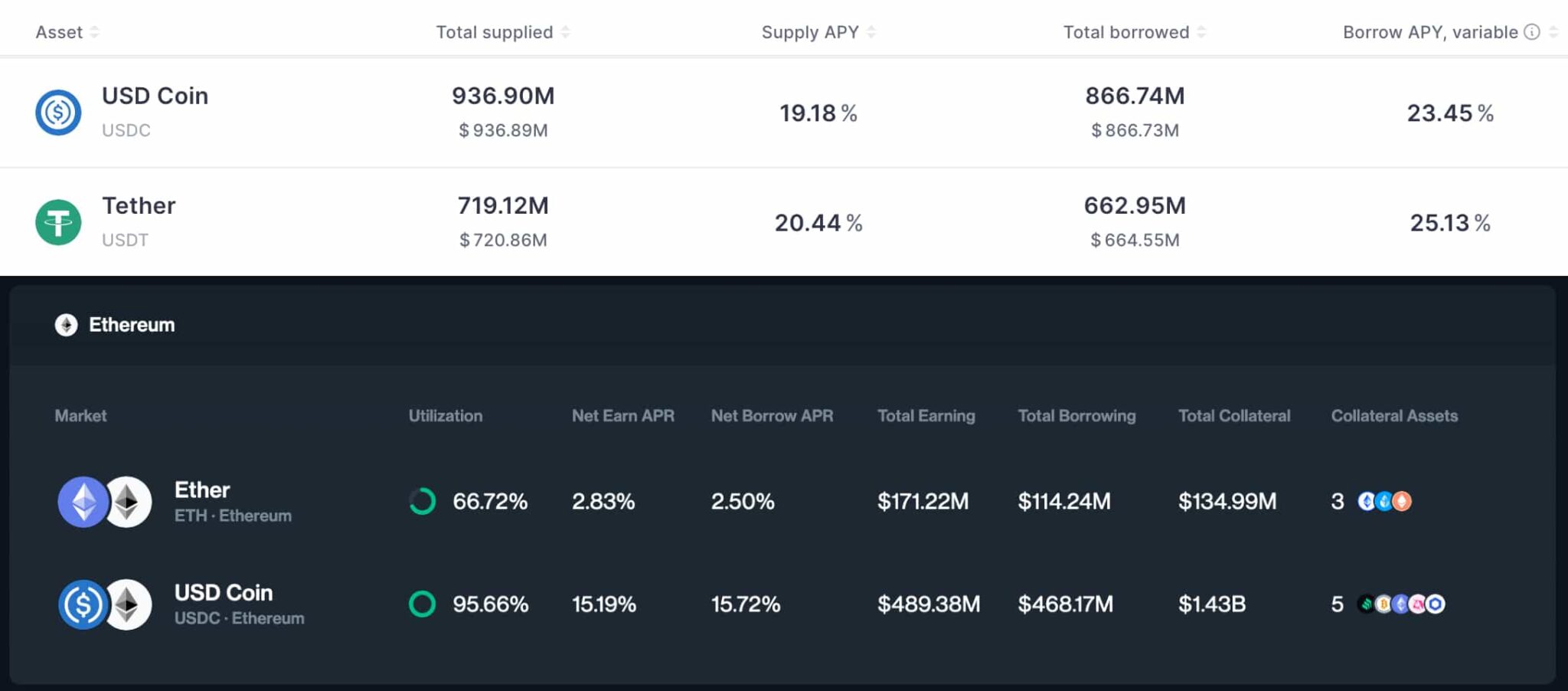

In particular, leading DeFi protocols running on Ethereum (ETH), like Aave (AAVE) and Compound (COMP), highly reward stablecoins’ suppliers. On Aave, investors can lend USDC and USDT with a 19.18% and 20.44% annual percentage yield (APY).

Meanwhile, Compound v3 offers 15.19% for Ethereum-based USDC. Lending the stablecoin on other chains like Polygon (MATIC), Arbitrum (ARB), or Base could reach even higher APYs. Finbold retrieved this data from each platform on March 10.

Notably, this is a consequence of a high borrowing demand, with traders willing to pay borrow-APYs as high as 23.45% and 25.13% for USDC and USDT, respectively, on Aave. These traders might use the borrowed stablecoins to speculate on cryptocurrencies, aiming for higher returns than their APY costs.

Crypto founders discuss stablecoins’ lending yield opportunity

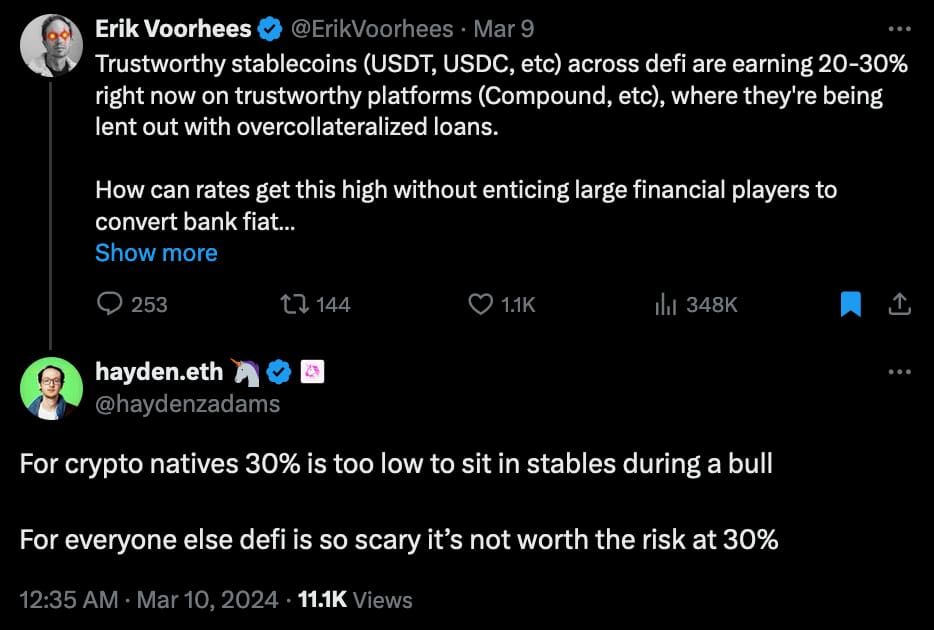

In this context, cryptocurrency project founders and influencers discussed this stablecoins’ lending opportunity on X (formerly Twitter).

First, Erik Voorhees, founder of ShapeShift, questioned why large financial players ignore this risk-allocation. ShapeShift recently settled illegal securities charges with the SEC, as reported by Decrypt on March 5. The company agreed to a cease-and-desist order and a $275,000 fine.

“How can rates get this high without enticing large financial players to convert bank fiat into stables and earn that yield? Gotta be one of the best risk-adjusted trades in the world right now… Am I missing something?”

– Erik Voorhes

In response, Hayden Adams, founder of Uniswap (UNI), explained the paradoxical situation of these stablecoins’ lending yields. Interestingly, Adams believes 30% APY is not enough for “crypto native” investors, while traditional finance investors rather not take these risks. Uniswap is one of the leading decentralized exchanges in the market.

“For crypto natives, 30% is too low to sit in stables during a bull

For everyone else, defi is so scary it’s not worth the risk at 30%”

– Hayden Adams

In summary, lending platforms may offer appealing yield opportunities for supplying stablecoins like USDC and USDT. At the same time, traders can take the opposite direction by borrowing stablecoins and getting exposure to the cryptocurrency market’s short-term price speculation.

Nevertheless, both paths have relevant risks. Tether’s and Circle’s stablecoins are subject to these entities’ control, which can freeze or seize users’ balances and positions. Therefore, investors must weigh and evaluate this and other risks before deploying capital into appealing investment opportunities.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.