Stocks and ETFs connected to quantum computing have recently gained significant attention from the investing community. Stocks like IONQ, RGTI, QBTS and QUBT and ETFs, including QTUM, have registered massive growth in the last 30 days. Let’s examine the scenario. Ready?

Call Options Surge for Quantum Computing Stocks

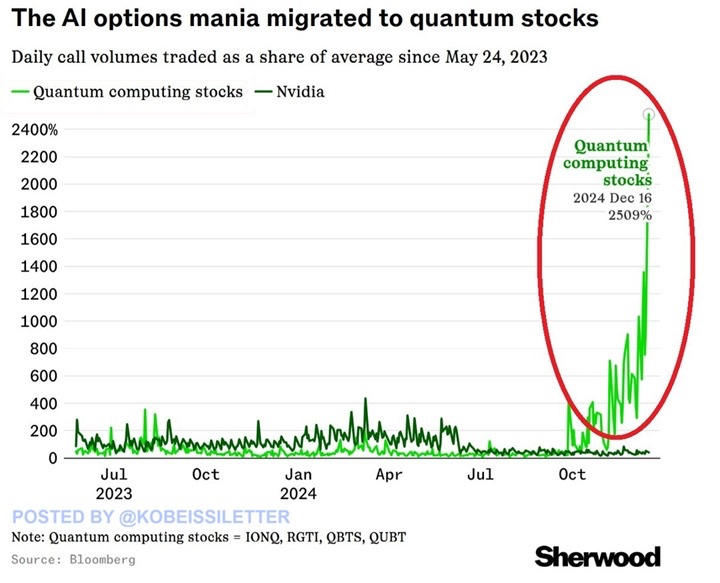

Reports suggest that the call options trading value for quantum computing stocks like IONQ, RGTI, QBTS and QUBT now stands at at least 2,500% above the average. Reports add that the call options volume on these stocks has increased nearly 10 times in the last 30 days.

Since December 1, the IONQ market has grown by 28.88%, RGTI by 262.91%, and QUBT by 197.71%.

Comparing Quantum Stocks to Nvidia

In March 2024, the call options volume of Nvidia grew at least 435% above the average. Reports show that the latest performance of quantum stocks is far more aggressive than what was witnessed in the Nvidia market in March.

QTUM ETF’s Impressive Growth

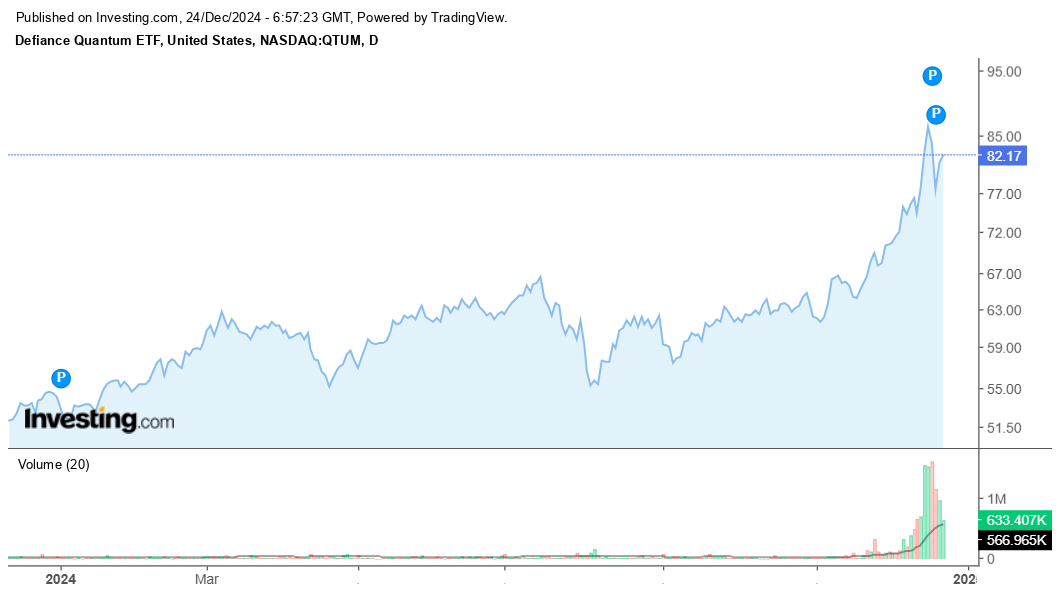

At the start of this year, the price of QTUM ETF was at $52.09. Since then, it has surged by 50.13%. At the beginning of this month, the price of the ETF was around $70.43. Since then, the market has seen a growth of over 16.39%. At a point this month, the market touched a peak of $86.66.

What the data reflects is ETF investors’ growing confidence in quantum computing technologies and their future potential.

A Global Market Trend Worth Watching

The quantum computing sector is gaining momentum as a transformative market. The latest surge signals a potential shift in investor focus towards emerging technologies that could redefine industries.

In conclusion, quantum computing stocks are rapidly gaining traction, with skyrocketing call options and ETF growth.