Crypto funding is on track to finish a highly active Q1, with up to $7.3 billion in funding rounds. According to Messari, 550 deals were wrapped up in the past quarter.

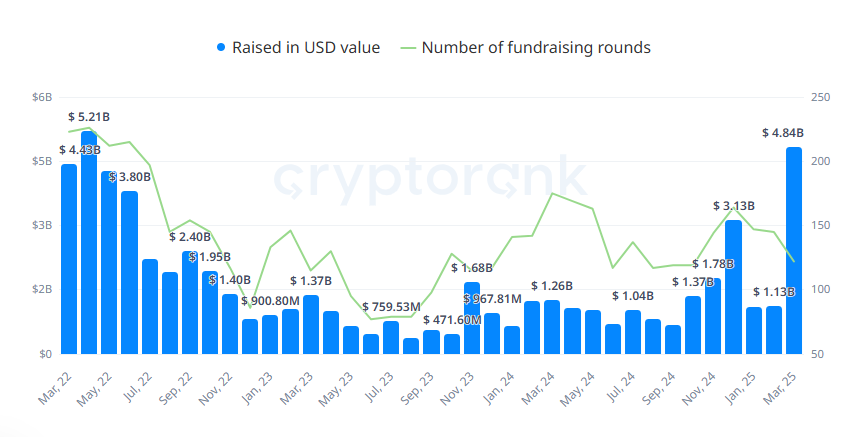

Crypto funding accelerated in March, expanding funding to $7.3B for Q1, 2025. Crypto funding usually follows the expansion stages of a bull market. This time, major assets remained subdued, but VC deals continued.

According to Messari’s data, crypto funding closed $154M in funding for just the past week, while the entire quarter was on track to surpass the previous slow months.

Despite the shift in focus on meme tokens, new projects and platforms are still building under all market conditions. Investment activity switched to ‘high’ after showing a ‘low’ indicator in January and February. Based on Cryptorank data, activity is up by 13% in the past month.

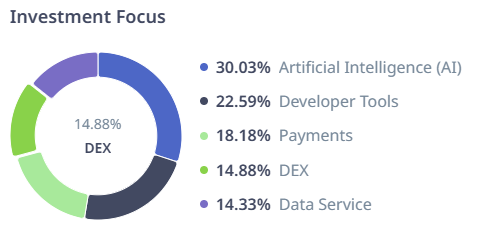

The top 12 funds have diverse investment portfolios, but all have a focus on AI funding. The projects include both AI agent platforms and AI infrastructure. AI takes up 14% to 22% of the Tier 1 top VC funds.

The expansion of AI affected crypto funding as well. Over 30% of deals flowed into AI projects, becoming the biggest investment sector. Over 22% of deals flowed into developer tools. A new trend emerged for payment services, taking up 18% of funding in the past month.

March was a particularly strong month for VC deals, as revealed by Cryptorank data. By the end of the month, a total of 122 deals were closed, raising a total of $4.84B. After two relatively slow months, March stood out as a period for rapid deal-making, suggesting older narratives may reawaken.

The recent growth comes from undisclosed rounds, while seed rounds still make up around 30% of all funding. The most common rounds are for $3M to $10M, followed by smaller fundraising of $1M to $3M. Those types of rounds make up around 60% of all funding activity. Around 6.28% of all deals are for over $50M.

Animoca Brands leads with the most funding rounds

For the first quarter of 2025, Animoca Brands and OKX Ventures were tied with 14 funding rounds each. Coinbase Ventures completed 13 funding rounds, and Amber Group closed 10 VC deals.

Animoca Brands stood out for being the only fund still trying to revive on-chain gaming. GameFi now makes the bulk of fundraising for Animoca Brands, with 177 deals to date.

In March 2025, a total of 30 GameFi deals were completed, with another 30 for blockchain services.

Animoca Brands completed its biggest round in March for Slingshot, a new GameFi project. The fund led an undisclosed round for $16M. Animoca Brands also supports NFT projects, remaining one of the last backers for this type of activity.

Despite the recent revival, VC funding is still down from the levels of 2021. Quarterly funding easily surpassed $10B during the 2021 bull market. The current recovery helped the market reach 50% of that level.

Token-based fundraising slows down

The first three months of 2025 caused token fatigue after the launch of thousands of meme tokens. For that reason, token launchpads saw a significant outflow of activity and significant losses from most launches. Only Bybit retained its positive ROI, with 700% in gains for the first three months of 2025, while other platforms posted significant losses from their token launches.

Overall, private token sales made up just 2.8% of VC rounds, as more projects decided to go tokenless. Offering tokens to early VC backers continues to be a red flag for projects, due to selling pressure over the years.

Token creation is more curated, with some of the new TGE happening on the Binance ecosystem. Each launchpad is becoming specialized in different types of tokens. Gate.IO is the leader in launching GameFi assets, while others focus on DeFi tokens.