- BTC liquidation nearly at $104,700 prices saw James Wynn lose $25 million.

- He pointedly accused market makers of suppressing Bitcoin, calling for community support.

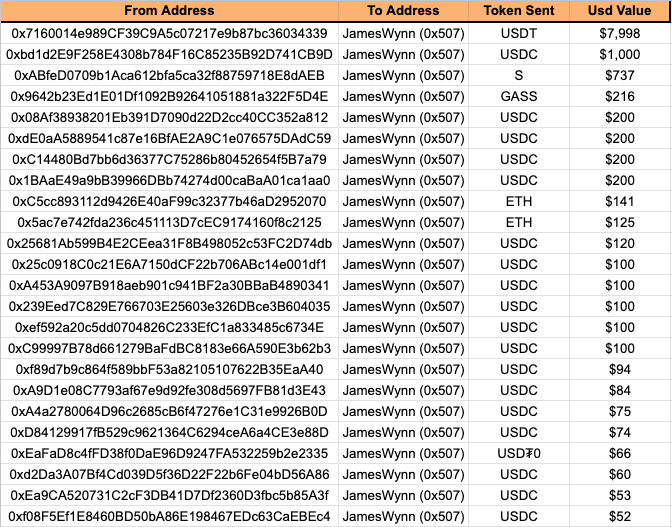

- More than 20 blockchain users sent him stablecoins to back his next trading positions.

Crypto trader James Wynn has been liquidated to take $25 million by Arkham Intelligence and on-chain activity. The liquidation happened when Bitcoin fell to $104,720 and imposed a market order selecting to close a 240.3 BTC long position, trade logs show. It came just days after Wynn suffered $100 million in losses on the May 30 selloff that pushed BTC below $105,000.

THE MATRIX IS ATTACKING JAMES WYNN

HE JUST GOT LIQUIDATED FOR $25 MILLION USD pic.twitter.com/g9o9RmyLIO

— Arkham (@arkham) June 4, 2025

Increased volatility ahead of the U.S. jobless claims report on Friday, June 5th, explains the timing of Wynn’s high-leverage position and rapid liquidation. Support levels have come closer to the $103,000 region as market sentiment has continued to be cautious.

On X, formerly known as Twitter, Wynn notes that he believes market makers purposely manipulate BTC prices to prevent upside momentum. “They ain’t letting the market run freely, “ he wrote. ‘Prove me wrong.”

Blockchain Donations Pour In as Supporters Back Wynn

Wynn is still in the news despite a massive loss. At least 24 blockchain users have funneled stablecoins to his wallet, although one address has sent almost 8,000 dollars. His donations appear to back his open defiance against what he calls the “market-making cabal.” The pseudonymous investigator ‘dethective’ reviewed on-chain data showing the fund transfers.

Wynn had previously appealed to the crypto community to help sustain his trading strategy, promising reimbursement ‘assuming’ he wins. The reaction within the trading community has been both criticism and sympathy, turning him into a polarizing figure.

He also alleges that some of his crypto exchange accounts were shut down without any notice, though that claim is as yet unverified. This aligns with increasing concerns about centralized exchange transparency and opaque user account treatment during times of high-stress trading.

History Repeats as Leverage Wipes Out Crypto High-Rollers

Wynn’s story follows that of other traders who lost vast sums of capital by utilizing aggressive leverage on the back of past market events. In similar conditions, derivatives trader Alex Wice lost $100 million in 2021. During earlier cycles, anonymous figures such as SteveS and TheBoot ruled forums to disappear with large losses.

Wynn’s approach also hints at wider risks in highly leveraged trading environments, analysts say. While some traders view his stance as bold, others see it as a cautionary tale about the dangers of fighting directional market flows.