The crypto industry experienced a transformative year in 2024, marked by rapid user acquisition and shifting ecosystem dynamics.

A new report from Flipside highlights significant growth in user engagement, particularly on Base and Ethereum, while decentralized exchanges (DEXs) and new blockchain projects reshaped the competitive market.

On-Chain Growth and Emerging Market Dynamics

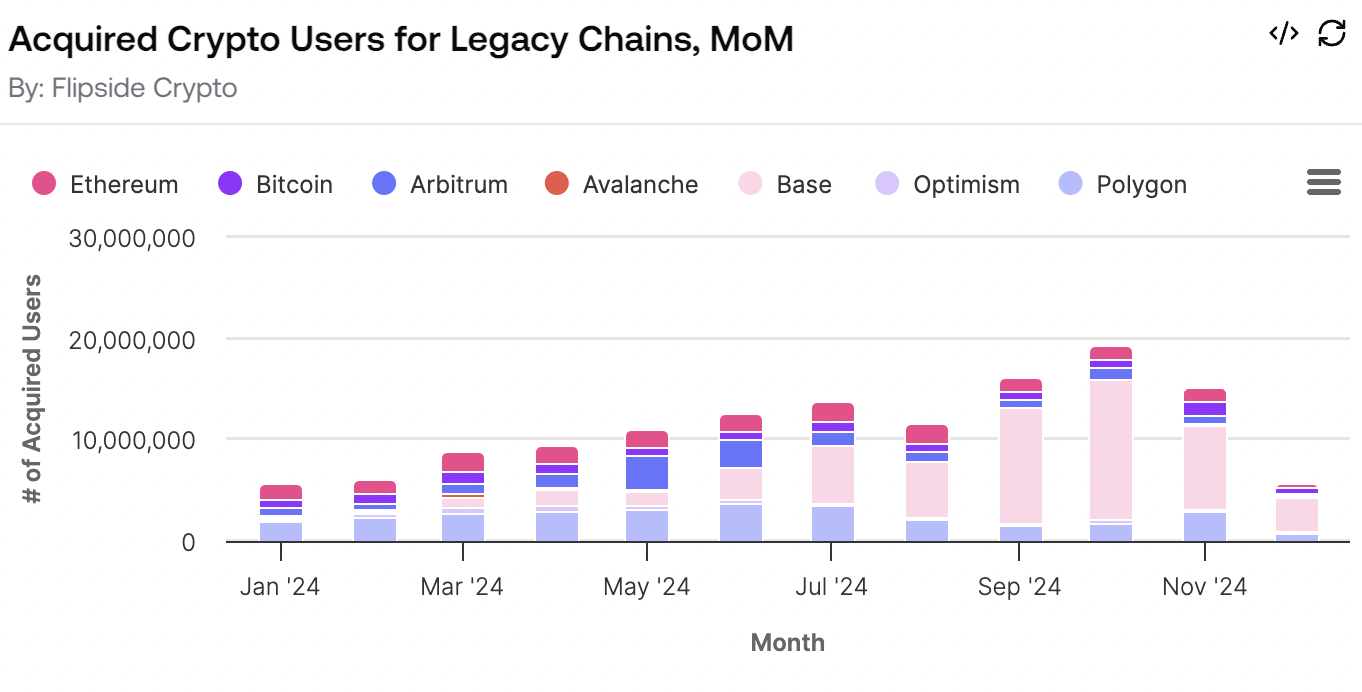

Base, a blockchain platform developed by Coinbase, led the market in 2024 with 13.7 million new users in October alone. This surge positioned Base as the fastest-growing chain, outpacing Ethereum’s steady average of 1.56 million new users per month. In comparison, Bitcoin’s growth lagged despite its price reaching $100,000, signaling speculative interest rather than new user onboarding.

Ethereum’s consistency as a user acquisition leader supports its established position, but Base’s rapid growth demonstrates the potential for newer chains to disrupt the ecosystem. Polygon also saw engagement, leveraging non-DeFi activities to broaden its user base.

Base attracted 15.1 million super users—those with over 100 transactions—surpassing even Ethereum and Polygon. This milestone reflects Base’s ability to sustain active engagement, positioning it as a standout platform. Polygon, in contrast, excelled by diversifying its activities and maintaining high transaction volumes across gaming and non-financial use cases.

Flipside Report Reveals How DEXs Evolve

Uniswap solidified its dominance in the decentralized exchange sector, capturing 91.3% of acquired user activity on Base. On Ethereum, Uniswap’s share also grew, reinforcing its position as the market leader. Trader Joe maintained its lead on Avalanche, supported by features like Auto-Pools and multi-chain capabilities.

These shifts illustrate the increasing consolidation of DEX activity around major players, highlighting a maturing market. However, newer chains face the challenge of balancing innovation with user retention.

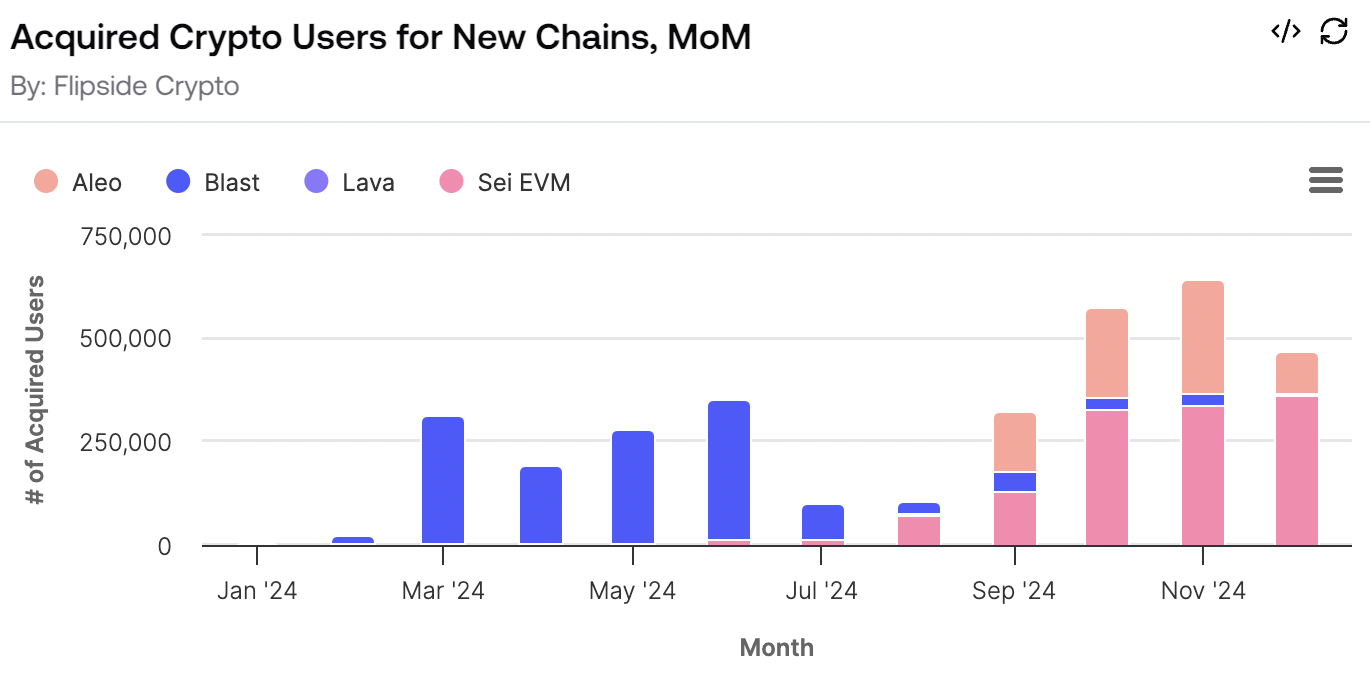

New blockchain networks like Aleo demonstrated promising growth but face hurdles in sustaining user engagement. Base, by comparison, emerged as a model for scaling engagement through features and partnerships. These new ecosystems must expand beyond trading to compete effectively in the broader crypto space.

Macro Trends Drive Institutional Confidence

According to the Flipside report, regulatory clarity played a crucial role in shaping the 2024 crypto space. The EU’s Markets in Crypto-assets Regulation (MiCA) bolstered institutional confidence, encouraging ETF launches and greater adoption. These developments supported consistent user growth across leading chains.

Ethereum remains a critical foundation for innovation, particularly for Layer 2 solutions. While Ethereum continues to grow its user base, fostering deeper engagement and new use cases remains a challenge.

As the crypto market matures, new trends like GameFi and artificial intelligence integration are expected to drive adoption. These innovations could address scalability and data management challenges, unlocking opportunities for broader user engagement.

“Behind the headlines of record user growth lies a deeper challenge: building ecosystems that create meaningful, lasting engagement, not just fleeting speculation. In short, most blockchains are still scratching the surface when it comes to turning casual users into high-value contributors,” the report stated.

Flipside’s report highlights a pivotal year for crypto, where established platforms competed with emerging ecosystems. The future will depend on how chains balance innovation, user retention, and regulatory adaptation to sustain momentum in 2025.

With platforms like Base leading the way and Ethereum cementing its dominance, the competition for user activity and engagement is far from over.