Roughly 40 days ago, Bitcoin.com News disclosed that the Royal Government of Bhutan, via Druk Holding and Investments (DHI), had moved 600 BTC, and at the time, held a balance of 10,070 BTC. Since that report, Bhutanese officials have evidently parted ways with 2,584 BTC—shedding approximately $248 million in digital assets.

Bhutan’s Bitcoin Hoard Shrinks

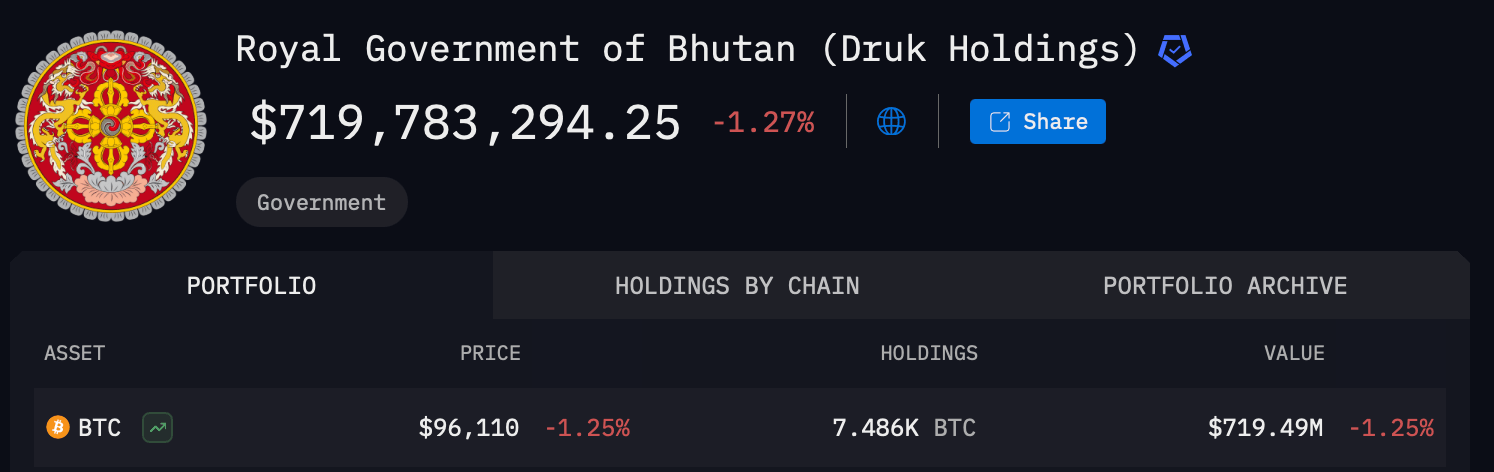

In April, Bhutan, ranked fourth globally among sovereign bitcoin holders, trimmed its reserves. On March 24, Arkham Intelligence data showed the government’s bitcoin holdings at 10,070 BTC. As of now, that figure has dwindled to 7,486 BTC, currently valued at just close to $720 million. Over the 40-day stretch, the nation’s holdings declined by exactly 2,584 BTC.

Every coin from the recent transfers was directed to separate, unidentified addresses. Bhutan remains singular in its approach, acquiring its bitcoin entirely through mining operations. While the divestments may have served to bolster its mining facilities, Prime Minister Tshering Tobgay has also stated that bitcoin liquidations have contributed to national healthcare programs and adjustments in public sector wages.

Neither Bhutanese officials nor DHI—the state’s sole government-owned holding company and custodian of its bitcoin—have issued any public remarks concerning the reduction in April. Still, Bhutan continues to outpace El Salvador in terms of its total BTC holdings and is still the world’s fourth-largest nation-state holder.

Currently, the United States leads with 198,012 BTC, trailed by the United Kingdom at 61,245 BTC. North Korea holds third, with the Lazarus Group—an entity associated with state-sponsored cyber activity—managing 8,358 BTC, slightly ahead of Bhutan’s current figure of 7,486 BTC.

El Salvador rounds out the top five with 6,166 BTC, gradually building its reserves with daily purchases of 1 BTC. The United Kingdom stands alone among these nations as the only one not approaching its holdings as part of a long-term national strategy.