What’s Next For Bitcoin?

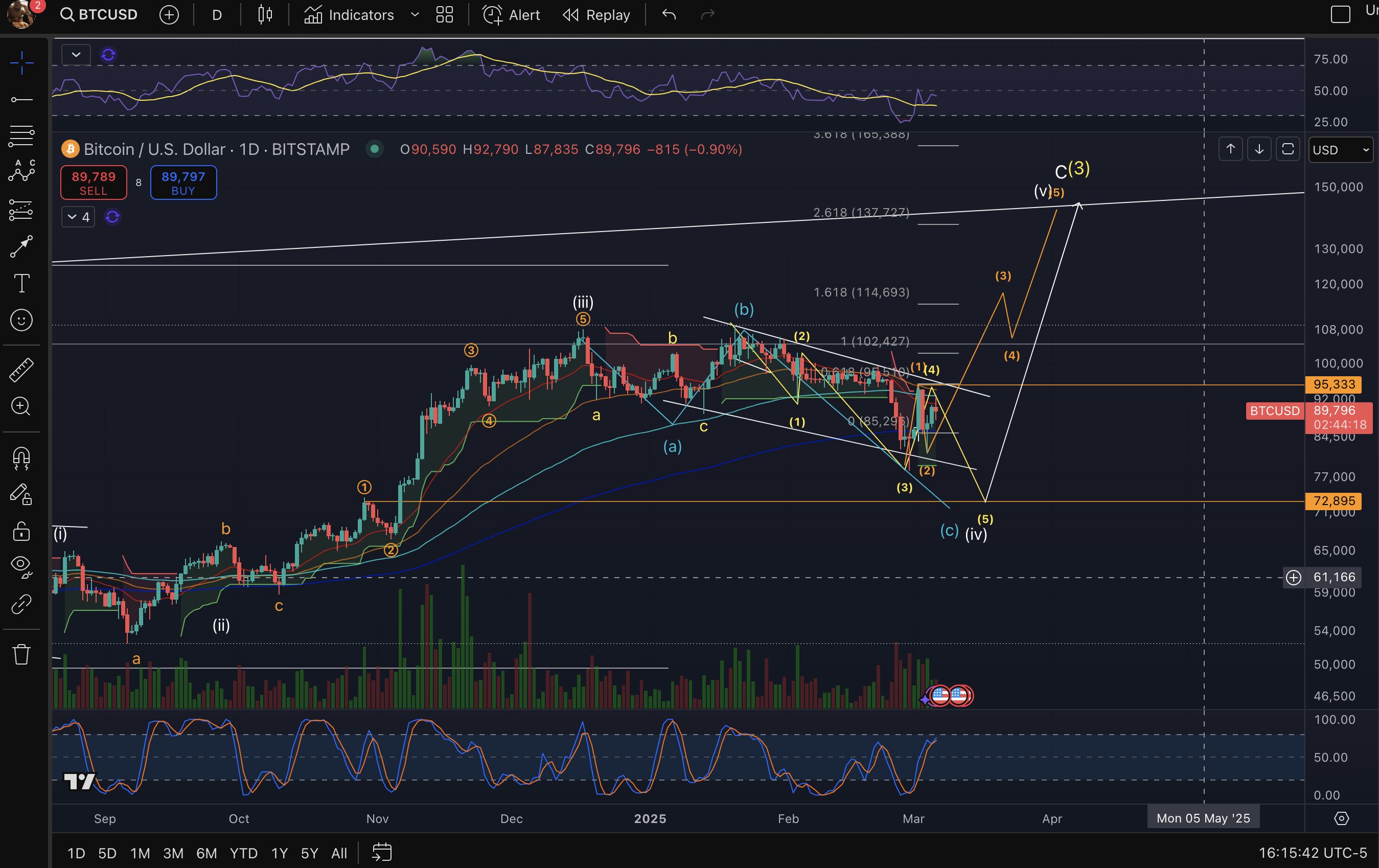

Big Mike’s chart displays a complex Elliott Wave structure consisting of five main impulse waves and interspersed corrective sub-waves. A key area labeled near $72,895 corresponds to wave (c)(iv), representing a major potential bottom if the market breaks below $78,000 and continues lower.

Notable corrective waves around $85,000 to $95,000 appear to have formed a larger consolidation phase, which he regards as a precursor to the next directional move. The chart also pinpoints an upside pathway from roughly $95,000, projecting impulse waves (3), (4), and (5) that extend into the $100,000–$140,000 zone.

Fibonacci extension targets appear at approximately $114,693 (1.618 extension) which could be the target for wave (3), followed by a corrective move to $102,000 before starting wave 5 which aims for $137,727 (2.618 extension), or even a final leg near $150,000 aligns with wave c(3).

Moving averages in the $72,000–$90,000 range underscore the significance of support near $78,000–$72,895, while an upper band around $90,000–$95,000 represents a crucial resistance corridor. The analyst observes a descending wedge formation from mid-February to early March, spanning $95,000 down to $85,000, and notes that an upside breakout could herald a renewed push into six-figure territory.

Volume profiles indicate subdued participation during recent corrective phases, alongside a neutral Stochastic RSI reading that suggests momentum could shift decisively depending on which price threshold gives way first.

Big Mike emphasizes two critical lines in the sand: “BTC above $95k will trigger the move quickly towards my target of $130-$140k. Below $78k and we test $72k, then run to $140k.” From his perspective, both a direct break above $95,000 and a deeper dip to $72,895 ultimately converge on the same upside target near $130,000–$140,000.

At press time, BTC traded at $90,053.