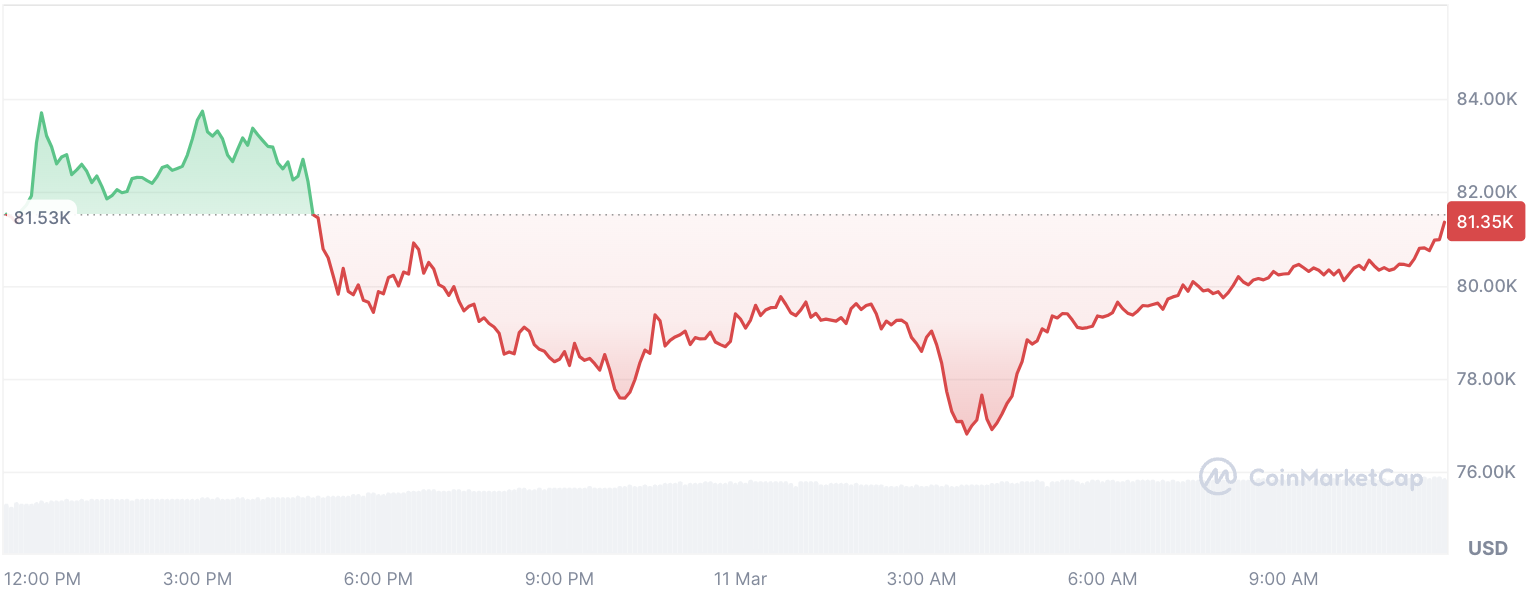

David Schwartz does not seem too concerned. While Bitcoin takes another dip - down 1.39% in the last 24 hours, 2.74% in the past week - the Ripple CTO and XRPL architect sees a buying opportunity, not a crisis. To him, this is just another moment in the market cycle, one that presents a chance to buy rather than panic. Others are not so sure.

Bitcoin’s price now sits at around $81,000, part of a broader crypto downturn that has seen the market drop 8.5% overall. Swings of 10% up and down over the past week have only added to the uncertainty.

Meanwhile, the political landscape is shifting. U.S. states are actively discussing the creation of a Bitcoin reserve, a plan formalized last week by the new administration.

The idea?

Use BTC already confiscated by the U.S. Treasury to fund the reserve, alongside a separate stockpile for non-Bitcoin digital assets. With an estimated 200,000 BTC in government possession as of March 2025, the U.S. is already the largest known state holder.

For some, Bitcoin’s latest price move could not have come at a worse time. Market instability does not exactly inspire confidence when policymakers are weighing its long-term role in state reserves. Schwartz, however, is not worried.

When questioned about Bitcoin’s purpose beyond enriching early adopters, he shrugs off the debate. Some care about that question, some do not - and he is fine with both.

It is a familiar divide. Bitcoin skeptics continue to ask what it truly offers beyond speculation, while long-time believers like Schwartz see price drops as nothing more than opportunities.

One side wants answers. The other? They just keep buying. And as Bitcoin’s price keeps moving, that debate is not going anywhere.