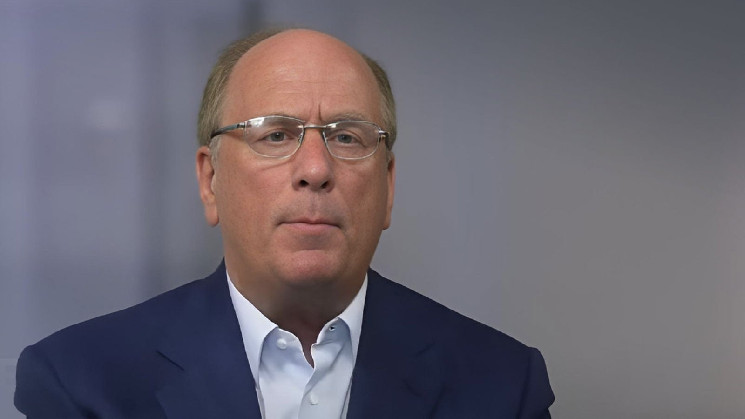

Larry Fink, the head of $11.5 trillion asset management behemoth BlackRock, has recommended that investors buy a \"big dip\" if there is one in 2025.

Fink has predicted that this year will be turbulent for the markets due to the tensions related to tariffs.

However, he remains optimistic in the long term, predicting \"a big economic boom\" driven by such cutting-edge tech as artificial intelligence (AI).

He believes that the US stock market will pushed higher by the country\'s tech advantage over the next several years.

Earlier today, the S&P500 plunged sharply lower amid trade tensions and concerns about the health of the US economy. The price of Bitcoin, which tends to be correlated with other risk assets, also plunged to an intraday low of $81,688.

However, Bitcoin has since pared some of the losses in tandem with U.S. stocks.