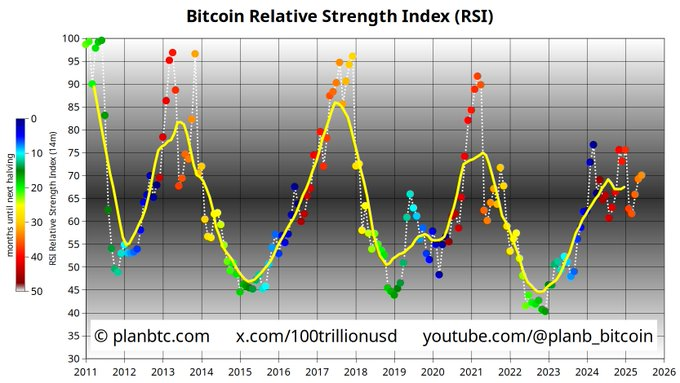

Bitcoin is attracting interest this month, with analysts noting that it could revisit certain key price points. Analyst Plan B considers revisiting the RSI 75 level as ideal for Bitcoin to move beyond $130,000 by June. The market relies on conquering the $130,000 price point to sustain upward momentum.

Bullish Sentiment Rises Amid Heavy Short Liquidations

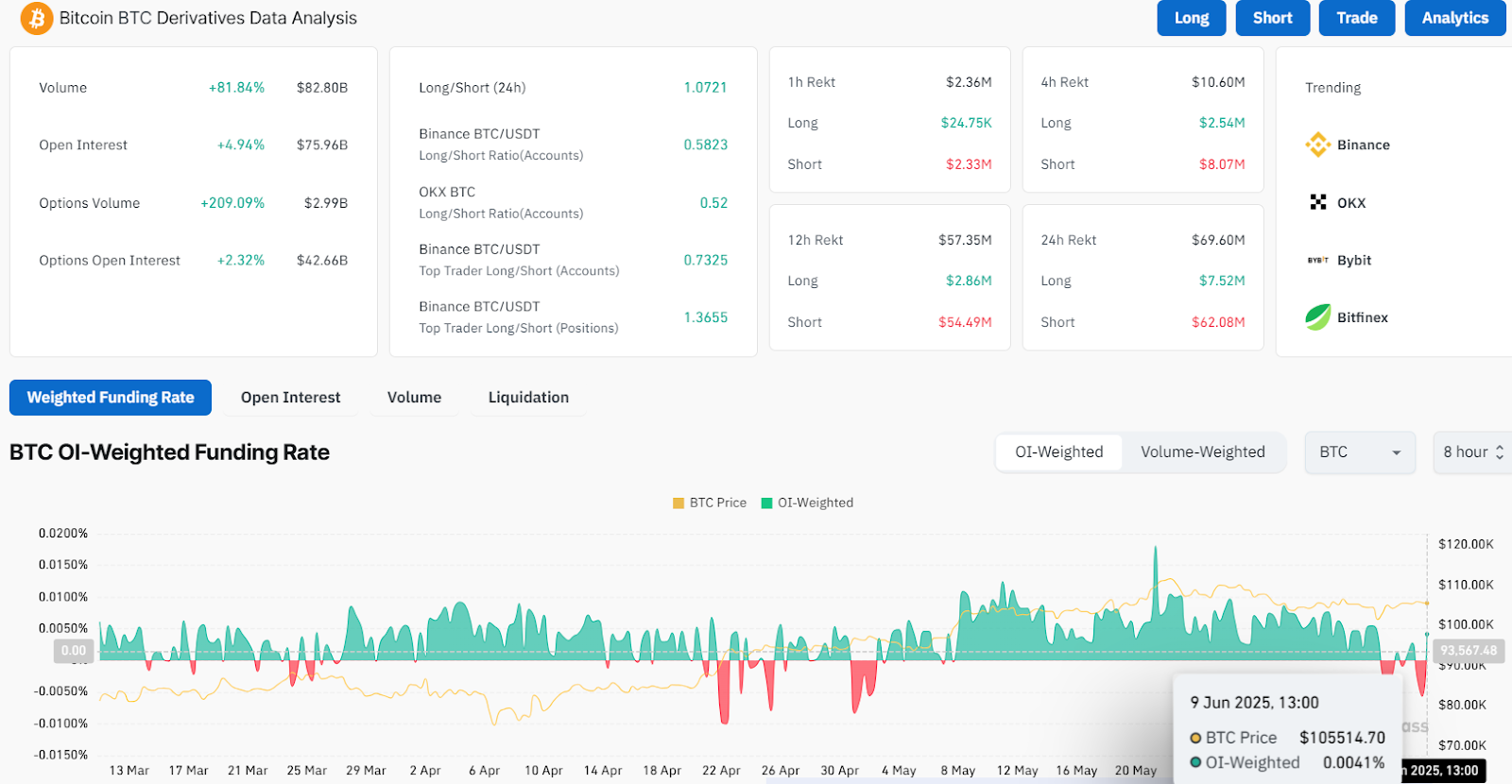

According to the analytical platform Coinglass, the overall open interest increased by 4.94% to $75.96 billion, and the OI-weighted funding rate shifted from negative to positive at 0.0041%. The current long-to-short ratio of 1.071 is optimistic, showing that most traders have a bullish outlook. Yet, in the past 24 hours, the amount of long assets liquidated rose to $7.52 million, but is much lower than the $62.08 million for short liquidations.

Bitcoin’s Growth Potential: Holding Key Levels Fuels Momentum

Analyst Michael van de Poppe noted that Bitcoin may attract additional buying interest if it remains above key levels. With buyers entering the market and sellers having to cover their losses, this may cause assets to rise further. As Bitcoin approaches $108,900, its upward trend is expected to accelerate.

He pointed out that if Bitcoin stays above important levels, its price is more likely to rise. As long as Bitcoin sustains above the support level, additional purchases by traders could boost the upward trend.

Bitcoin’s Bullish Outlook

Analysts expect this week to be marked by more positive developments. Bitcoin has the potential to surpass the current resistance it is facing. If this happens, there may be a larger jump in Bitcoin’s price in the following days.

As long as Bitcoin keeps moving forward and stays above certain highs, the $130,000 target is possible. As of press time, BTC is trading at $107,778, up by 1.64% over the past day.

The current surge in BTC’s open interest and a rise in the funding rate suggest that June could indicate positive results. Positive sentiment among traders keeps the bulls in charge, though the increase in long liquidations is a concern. Traders should remain vigilant for key levels and observe how prices are behaving, as Bitcoin continues to surge.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.