U.S. President Donald Trump has criticized Federal Reserve Chairman Jerome Powell multiple times over the past few months for not cutting interest rates.

BTC Treads Water as Trump Demands Rate Cut

The U.S. Federal Reserve maintained its target range for the federal funds rate between 4.25% and 4.5% last month, explaining that “inflation remains somewhat elevated” in its official statement. And now, with the central bank’s June 17-18 meeting fast approaching, President Donald Trump isn’t mincing his words.

“ADP NUMBER OUT!!! ‘Too Late’ Powell must now LOWER THE RATE,” the president posted on Truth Social. “He is unbelievable!!! Europe has lowered NINE TIMES!”

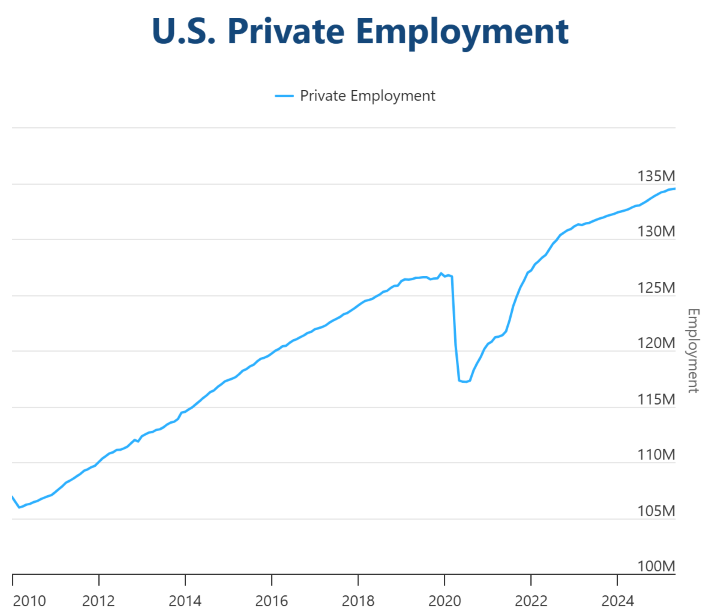

Indeed, Roseland New Jersey-based human resources firm ADP published a press release on Wednesday morning showing that only 37,000 private sector jobs were created in May, the lowest pace of hiring in more than two years. Bitcoin was mostly flat on the news, bouncing around the $105K threshold throughout the morning. But stocks edged higher, with the S&P 500, Nasdaq, and Dow all climbing 0.23%, 0.35%, and 0.10% respectively, according to CNBC.

“After a strong start to the year, hiring is losing momentum,” said ADP Chief Economist Dr. Nela Richardson. “Pay growth, however, was little changed in May.”

Overview of Market Metrics

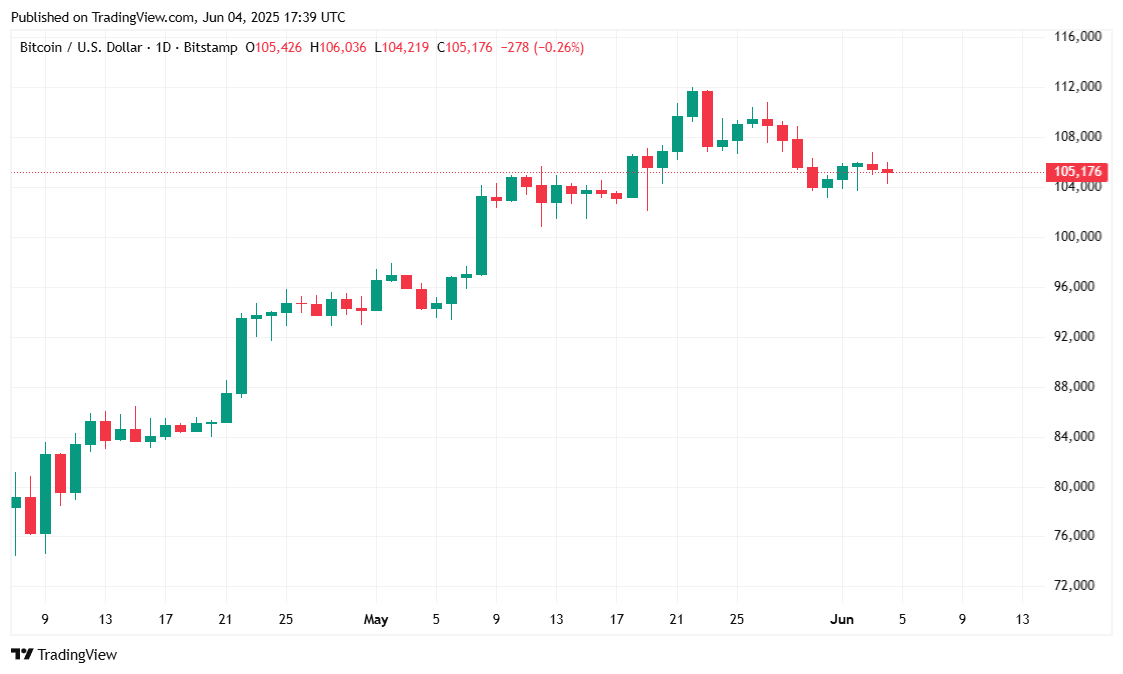

Bitcoin slid slightly by 0.70% over the past 24 hours and was trading at $105,234.99 at the time of reporting. The cryptocurrency has now lost 2.08% over the past week, with today’s price action largely confined to a narrow range between $104,232.70 and $106,457.19. The broader crypto market was also down by roughly the same percentage – 0.72%, according to Coinmarketcap.

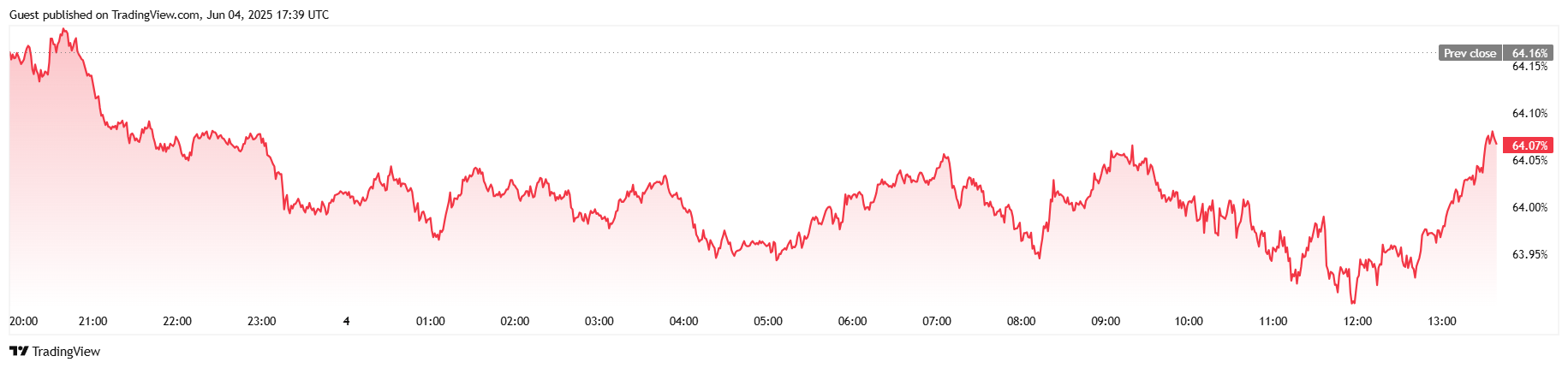

Trading volume dipped 6.15% to $44.48 billion, as momentum cooled across the board. Bitcoin’s market capitalization fell by 0.82% to $2.09 trillion, and its dominance dropped by 0.16% to 64.06. Open interest in BTC futures also edged down 2.02% to $70.58 billion, showing a retreat in leveraged bets in the wake of lackluster price action.

Liquidation activity was significantly lower than usual, with just $62,970 in total positions wiped out in the last 24 hours, according to Coinglass. However, longs accounted for $56,780 of that total, once again placing bulls on the losing end of the latest market move. Shorts recorded a much smaller $6,190 in liquidations.