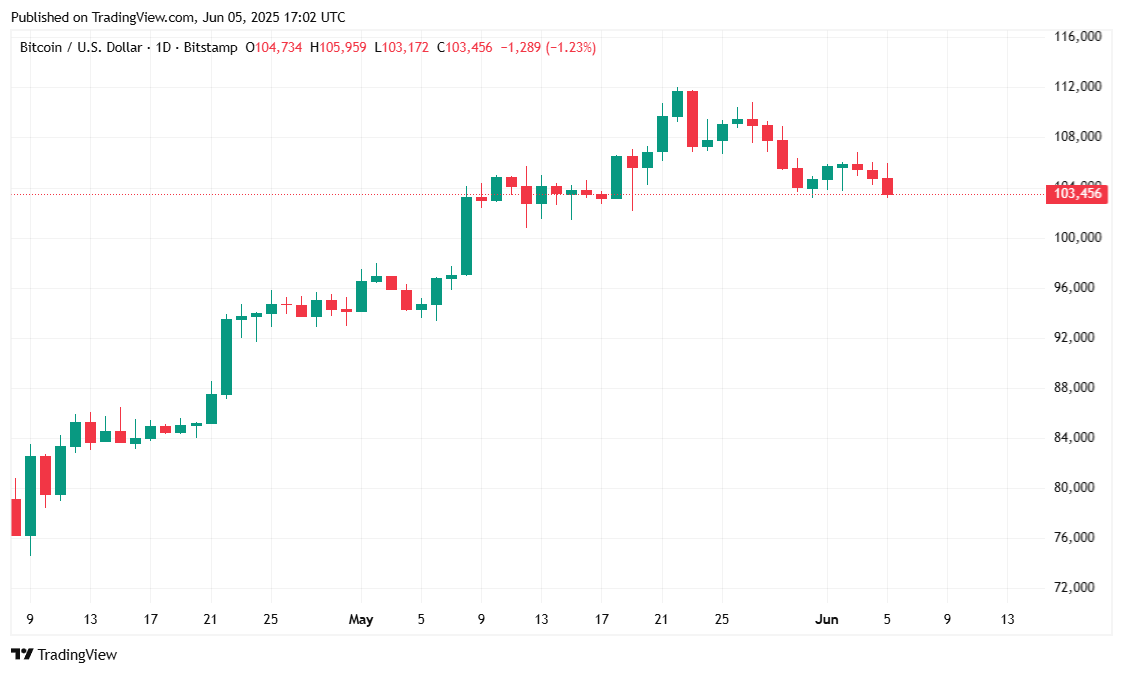

The cryptocurrency has traded mostly sideways all week, seemingly unmoved by key developments in the broader economy.

Stocks Tread Water as Bitcoin Flatlines

U.S. President Donald Trump announced that he had just finished a “very good phone call” with Chinese leader Xi Jinping on Thursday morning, initially sending stocks upward, but bitcoin ( BTC) barely budged, and stocks later retreated.

“I just concluded a very good phone call with President Xi, of China, discussing some of the intricacies of our recently made, and agreed to, trade deal,” Trump said, referring to the agreement in May in which the two countries scrapped the triple-digit retaliatory tariffs previously imposed on each other. “The call lasted approximately one and a half hours and resulted in a very positive conclusion for both countries,” the president added.

Stock markets jumped on the news, with the S&P 500, Nasdaq, and Dow all initially climbing 0.41%, 0.72%, and 0.26% respectively, according to CNBC, but those gains had disappeared at the time of reporting. Coinmarketcap data shows that bitcoin edged lower by 1.84% and is currently trading just below the $104K mark.

Even a successful $1.05 billion initial public offering (IPO) by stablecoin issuer Circle (NYSE: CRCL), which went live today on the New York Stock Exchange, failed to buoy BTC and the wider crypto market. Coinmarketcap shows the crypto sector shrunk 2.24% to a market capitalization of $3.24 trillion.

Overview of Market Metrics

Bitcoin has dipped 1.84% over the past 24 hours to a current price of $103,517.75, according to Coinmarketcap. The decline extends a broader 7-day slide of 3.05%, with price action constrained between $103,483.65 and $105,936.69. The subdued movement suggests a wait-and-see approach among traders despite news about US-China trade developments and Circle’s IPO.

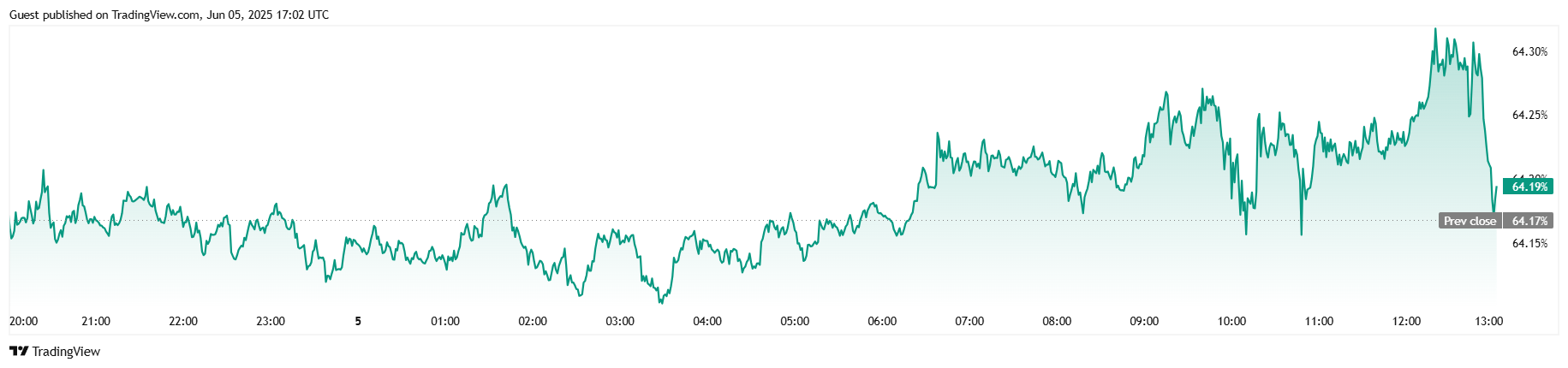

Market activity mirrored the price lethargy, as 24-hour trading volume dropped 8.06% to $41.84 billion. Bitcoin’s market capitalization declined by 1.85% to $2.05 trillion, while BTC dominance inched up 0.08% to 64.21%, hinting at relatively weaker performance from altcoins. Futures markets trended slightly higher, with total open interest rising 0.40% to $71.03 billion, reflecting a steady appetite for speculative positioning.

Margin trading data from Coinglass reveals an interesting shift: total liquidations were initially thin at around $83,770 earlier today, but later ballooned to $12.93 million, with bulls who went long getting liquidated to the tune of $12.84 million, while shorts came in at a much smaller $84,390.