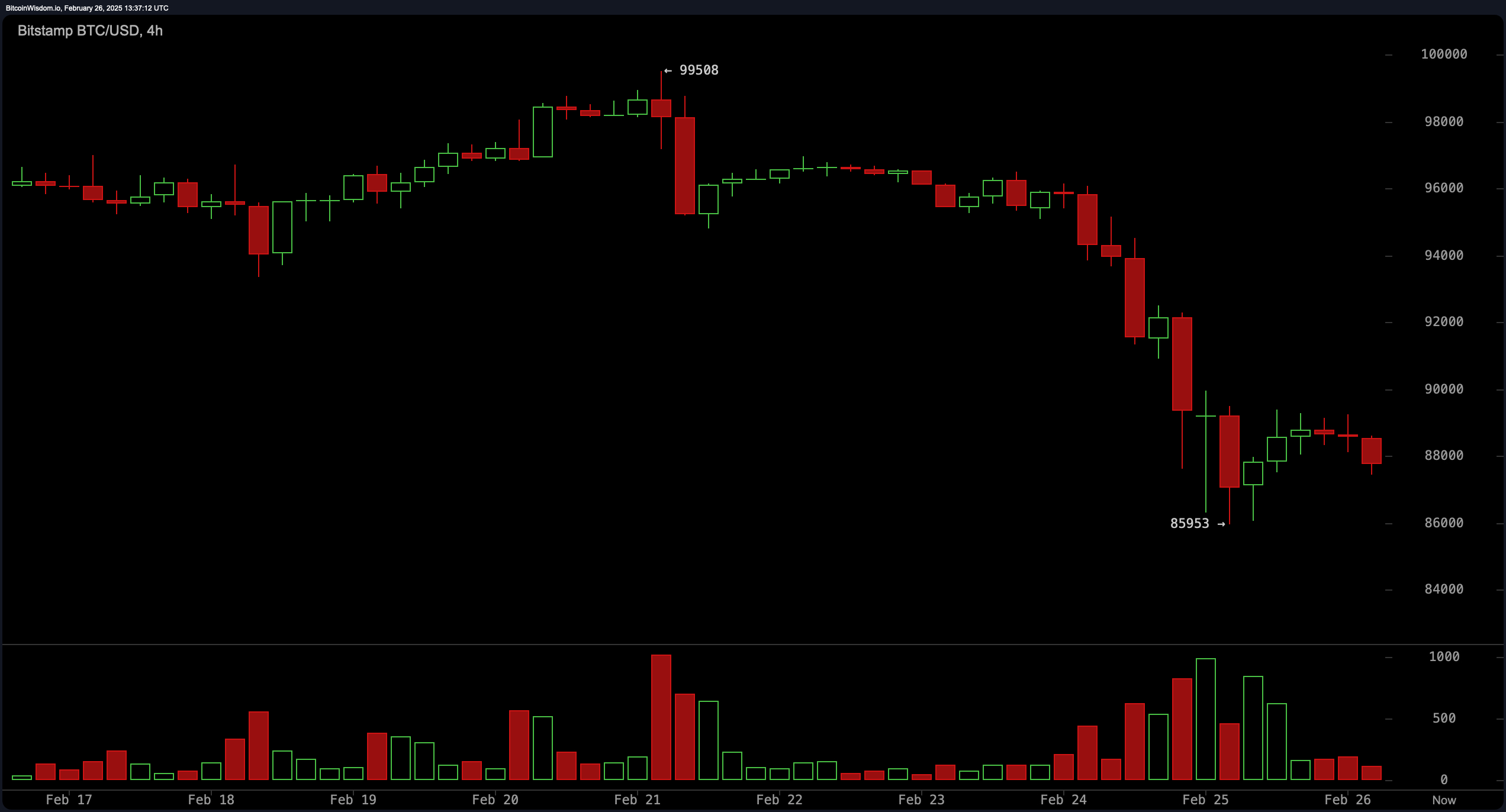

Bitcoin is down 1.9% against the greenback trading between $87,739 to $88,156 over the last hour on Feb. 26, 2025, extending losses amid U.S. economic policy anxieties and fluctuating consumer confidence.

Bitcoin Navigates Bearish Terrain

The leading cryptocurrency’s price declined from the previous day, marking a 24-hour drop of approximately 1.9%, according to the latest BTC price data. This follows a volatile week: Essentially, bitcoin traded near $99,334.93 on February 24 before sliding 11.1% over the last two days. Analysts attribute the swing to intraday trading pressures and macroeconomic headwinds from Trump’s tariff threats.

Market sentiment remains divided. Some traders advocate holding positions, citing resilience while other reports show bulls targeting $90,000 per bitcoin as a near-term resistance level. However, bearish momentum persists, with significant sell-offs and liquidations noted on Tuesday, Feb. 25. Sleeping bitcoins have also been waking up, like this 185.65 BTC cache from a dormant 2013 wallet that shifted yesterday.

Broader economic trends compound uncertainty. Recent U.S. tariff proposals and a 0.3% dip in January’s Leading Economic Index have eroded consumer confidence, per Reuters and The Conference Board. Deloitte Insights warns such policies could slow growth, indirectly pressuring bitcoin’s association with risk-on assets like equities.

Historically, bitcoin has thrived or remained resilient during economic instability. Yet its 2025 fluctuations—from the mid-$90K range on Feb. 18 to current lows—showcase sensitivity to macro trends. Investors now weigh short-term volatility against long-term forecasts, including varied 2025 projections of $75,000 to $200,000 per bitcoin.

While traders and analysts monitor recovery signals, February 26’s continued slump highlights bitcoin’s entanglement with global economic shifts. Over the last day, statistics show that over $402 million in derivatives positions have been liquidated, of which $274.74 million were made up of long plays. Traders are advised to track both crypto-specific metrics and macroeconomic indicators for clarity as the week continues.