Looking at a broader time frame, Bitcoin dropped below $100,000 on January 7 and has generally been on a downward trend since then. It hit a low of about $89,397 on January 13 but has begun to recover from this decline. Over the last 24 hours, its total market capitalization has risen by 1.03% to $2.08 trillion.

Bitcoin’s Large Transaction Volume Declines

Several analysts have observed that when Bitcoin’s price rises, the likelihood of establishing a Bitcoin reserve also increases. It appears that a price increase in Bitcoin makes the setup of a reserve more probable.

This week, Bitcoin’s price increased by 5.9% and saw a gain of 7% over the past 30 days. Today, Bitcoin’s price touched a high of $106,820 but didn’t attract enough buyers, leading to an immediate consolidation around $105K.

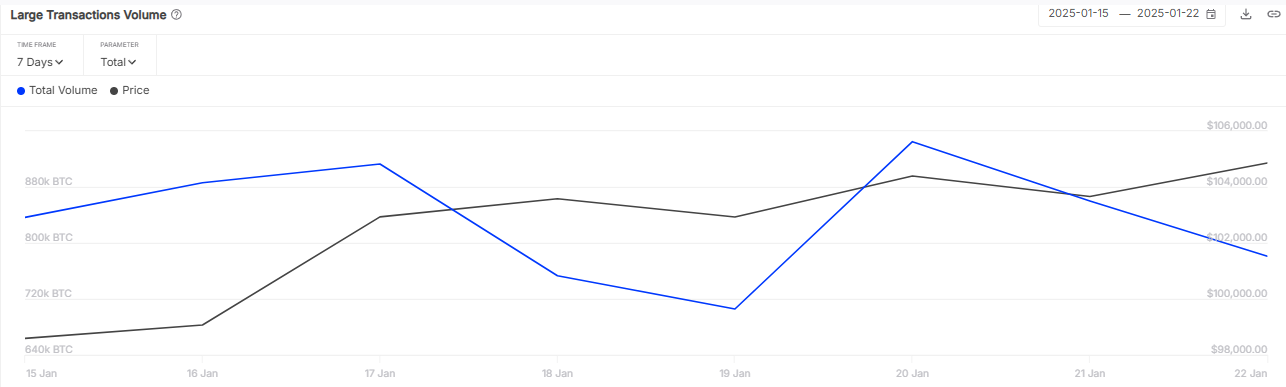

Over the last 48 hours, the large transaction volume of Bitcoin has been declining. Data from IntoTheBlock shows that the metric dropped from the peak of 944.7K BTC to a low of 781K BTC. This decline suggests a decreased interest in trading activity among whales.

As whales take less interest in Bitcoin, this might create a correction on the price chart. Additionally, the rising US debt might be a bearish threat for Bitcoin price, which might create a wave of selling activity among holders if BTC struggles to surpass resistance levels.

However, the funding rate of Bitcoin remains positive despite the bearish threat. It is currently at 0.0081%, suggesting that buyers still have the advantage in bouncing back from the current level and breaking through $108K.

Bitcoin Price Prediction: Technical Analysis

Bitcoin price has been on a strong surge as it successfully rebounded from the immediate support line. As a result, the price of BTC is attempting to hold above $107K-$108K. However, it is experiencing some selling pressure around the $107K level, creating a significant challenge for buyers. Right now, Bitcoin is priced at $105,471, having risen by 1.3% in the last 24 hours.

The Bitcoin to USDT trading pair is still just under $107K, which might pose a slight challenge. If it can stay above this level, it would be advantageous for buyers. The price could then break above $108,000 and surge to $111,000.

On the other hand, if the price drops below the EMA20 trend line on the 1-hour chart, sellers might push it back down to $104K. However, RSI suggests there might be a potential rise, as it’s currently at a level (53) that indicates buying interest.

Bitcoin Price Prediction: What to Expect Next?

Short-term: According to BlockchainReporter, BTC price might continue to struggle around $107K. On the other hand, it might retest $104K.

Long-term: According to Coincodex’s current Bitcoin price prediction, the price of Bitcoin is expected to rise by 24.60% and reach $131,278 by February 22, 2025. Coincodex’s technical indicators suggest a bullish current sentiment, while the Fear & Greed Index indicates a level of 75, denoting Greed. Over the past 30 days, Bitcoin has experienced 17/30 (57%) green days and exhibited 3.85% price volatility. Based on this forecast, Coincodex recommends that now is a good time to purchase Bitcoin.

Investment Risks for Bitcoin

Investing in Bitcoin can be risky due to market volatility. Investors should:

- Conduct technical and on-chain analysis.

- Assess their financial situation and risk tolerance.

- Consult with financial advisors if necessary.