At the start of this month, the price of Bitcoin was at the $82,539 level. Since then, the BTC price has declined by over 3.27%. However, currently, Bitcoin is showing a small sign of recovery as it is slowly inching back to the crucial $80K level. Meanwhile, on-chain indicators suggest panic selling by short-term holders, which some analysts believe is a long-term buying opportunity. With key resistance and support levels now in focus, the market could be on the edge of a major move. Curious to know more. Read on!

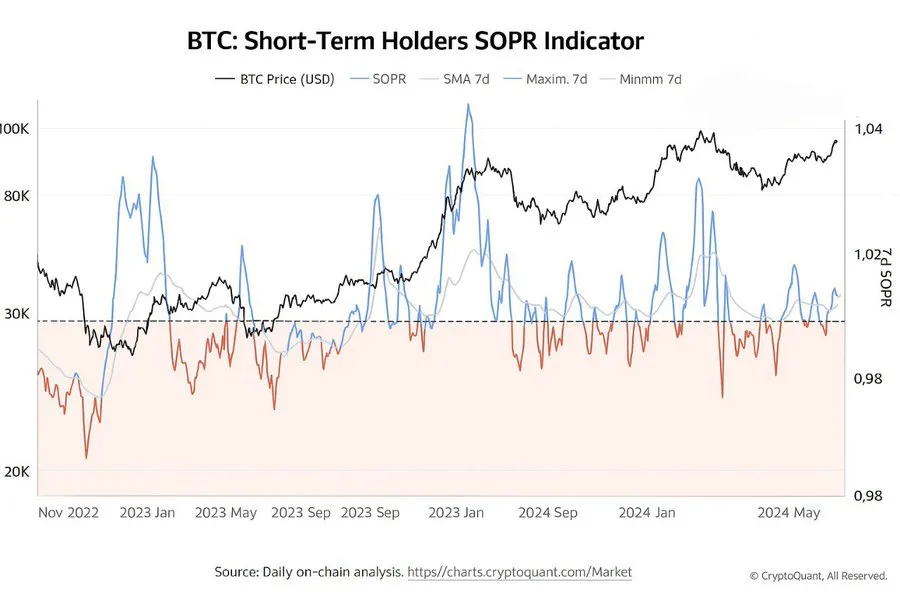

Bitcoin SOPR Signals Panic Selling – A Bullish Indicator?

The BTC Short-Term Holders SOPR indicator value is currently trending downwards. In other words, the BTC Short-Term Holders SOPR indicator shows panic selling.

The indicator shows if short-term cryptocurrency holders (who have held their coins for less than 155 days) are selling at a profit or a loss.

If the SOPR value is less than 1, they are selling at a loss.

This implies that a large number of short-term holders are selling their coins at a loss.

Flashback to Past BTC Dips: History Repeats for Patient Investors

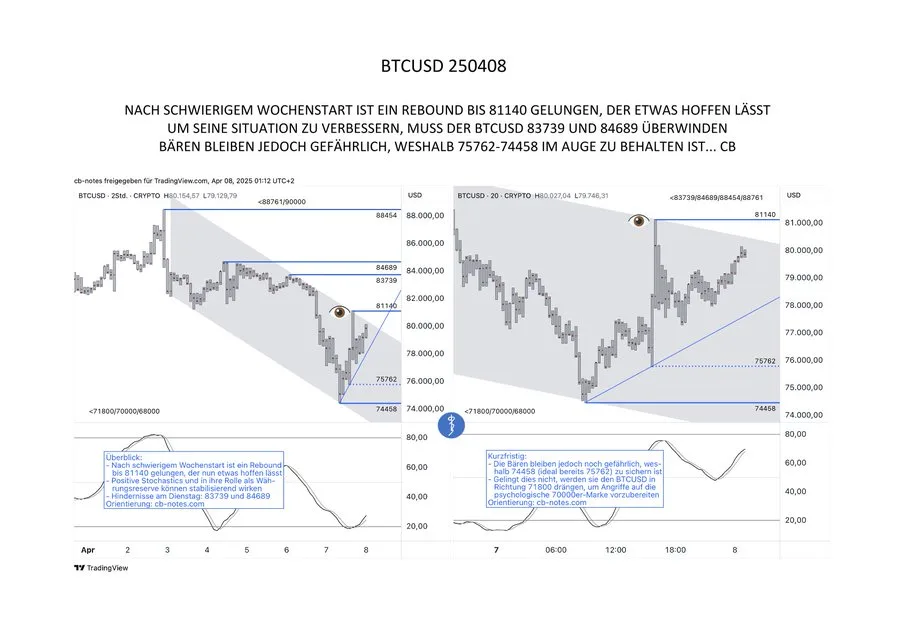

A crypto analyst, identified as FOUR Crypto Spaces on X, draws a comparison between the current BTC market dip and the $60K dip in 2024 and the $26K dip in 2023.

On April 6, the BTC market plummeted as low as $77,212, due to extreme market volatility.

The analyst warns that if Bitcoin drops below the range of $75,762 and $74,458, it could signal more downside risk.

Even though bearish pressure is present in the market, the recent bounce offers confidence to buyers.