- Bitcoin price stabilizes around $84,000 on Thursday after facing multiple rejections around the 200-day EMA.

- Fed’s hawkish remarks on Wednesday weigh on market sentiment for risky assets like Bitcoin.

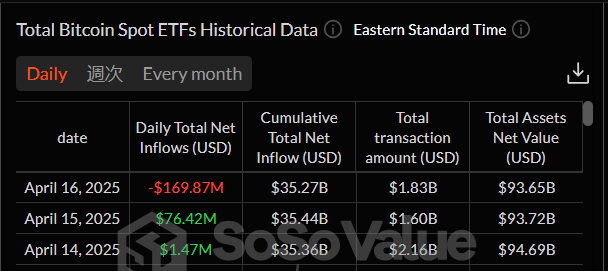

- US Bitcoin spot ETFs recorded an outflow of $169.87 million on Wednesday.

Bitcoin (BTC) is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day Exponential Moving Average (EMA) at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Federal Reserve (Fed) on Wednesday, BTC remains relatively stable. Meanwhile, institutional demand shows weakness, as it recorded nearly $170 million outflow from Bitcoin spot Exchange Traded Funds (ETFs) on Wednesday.

Bitcoin remains resilient despite the Fed’s hawkish stance

Bitcoin holds above $84,000 during Thursday’s European trading session, despite Fed Chair Jerome Powell’s hawkish remarks on Wednesday.

According to Haresh Menghani’s report at FXStreet, the US central bank was not inclined to cut interest rates in the near future, citing the potential inflationary pressure stemming from US President Donald Trump’s aggressive tariff policies.

On Wednesday, the US Census Bureau reported that Retail Sales climbed 1.4% in March, the most in over two years. The reading followed a revised 0.2% increase in the previous month and was better than the market expectation for a 1.3% rise.

Meanwhile, the equity market in Asia-Pacific largely advanced on Thursday. Moreover, traders are still pricing in the possibility that the US central bank will resume its rate-cutting cycle in June. This holds back the US Dollar (USD) bulls from placing aggressive bets while BTC shows signs of resilience.

Traders now look forward to the US economic docket, which will feature the usual Weekly Initial Jobless Claims release, the Philly Fed Manufacturing Index, housing market data, and Fed-speak to grab short-term opportunities.

US Bitcoin Spot ETF demand falls after a slight rise

Institutional flows have continued to weaken so far this week. According to the SoSoValue data, the US spot Bitcoin ETFs recorded a net outflow of $169.87 million on Wednesday after a slight two-day inflow totaling $77.42 million this week. If the net outflow continues and intensifies, Bitcoin’s price could see further correction ahead.

Total Bitcoin Spot ETFS netflow daily chart. Source: SoSoValue

Bitcoin Price Forecast: BTC momentum indicators show indecisiveness

Bitcoin has faced multiple rejections around its 200-day Exponential Moving Average (EMA) at $85,000 since Saturday. On Tuesday, BTC tried breaking above this level but was rejected again and declined by 1.12%. However, BTC stabilized at around $84,000 the next day. At the time of writing on Thursday, it continues to hover around this level.

If BTC closes above $85,000 on a daily basis, it could extend the rally to the key psychological level of $90,000. A successful close above this level could extend an additional rally to test its March 2 high of $95,000.

The Relative Strength Index (RSI) on the daily chart flattens around its neutral level of 50, indicating indecisiveness among traders. The RSI must move above its neutral level for the bullish momentum to be sustained.

BTC/USDT daily chart

However, if BTC continues its downward trend, it could extend the decline to retest its next daily support level at $78,258.