Cryptocurrency analytics firm Alphractal has issued a stark warning about Bitcoin’s long-term price action, saying the price is close to breaking a historical rule for the first time, approaching its four-year-old level.

The Critical Level for Bitcoin Is Around $63,000

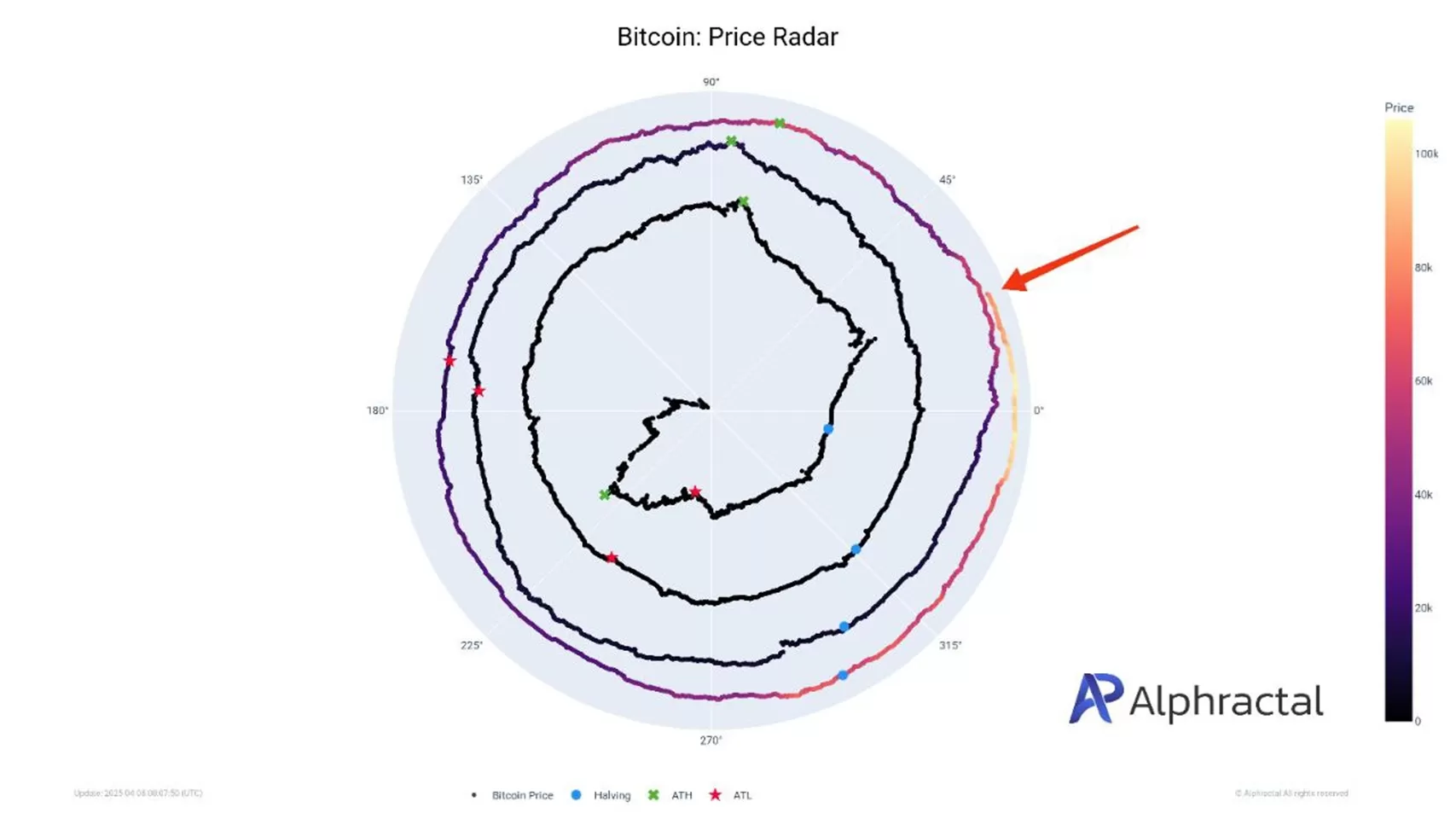

The model called “Bitcoin Price Radar” developed by Alphractal depicts four-year periods as a radar circle. In this model, halving periods, price peaks and bottoms are shown with symbols. Cycle peaks that come four years apart are represented by green symbols, and it is noteworthy that these peaks occur at very similar price levels.

However, if Bitcoin approaches or drops below the $63,000 level, the underlying assumption in this model will be broken, as to date Bitcoin has not tested a price level from four years ago for a second time. If this happens, it could mean increased volatility for long-term investors, according to the analytics company.

Alphractal noted that despite a possible deterioration, they did not exclude that the new peak could coincide with the old cycles, namely October 2025.

The analysis also notes that Bitcoin is currently approaching two strong support zones:

- Active Realized Price: $70,730

- Real Market Average Price: $64,480

According to the analytics firm, these levels have also acted as important support in the past. For example:

- The big drop in May 2021

- Bear market bottom in January 2022

- Stable support zone in 2023–2024

According to Alphractal, the Real Market Average Price stands out as a stronger support level and carries a high probability as a potential bottom area.

*This is not investment advice.