Bitcoin (BTC) recorded a mild recovery after falling straight from the $102,000 to $92,000 zone. The biggest crypto has been unable to reclaim the $100K mark even after many recent attempts, which has begun to spread doubt and FOMO among investors. However, analysts suggest that the $99,800 appears to be a make-or-break level for BTC.

The global digital assets market cap jumped by over 5% over the last day to stand at $3.43 trillion. The 24-hour trading volume saw a marginal decline but still hit the $280 billion mark. The Fear and Greed index also reflects “Greed” in the market.

Bitcoin on the brink of a breakout?

Bitcoin is testing a key resistance between the $97,500 and $99,800 price zones. This is the area where around 924K wallets bought over 1.19 million BTC (approximately worth $117 billion). Analysts suggest that a new all-time high could be on the horizon if BTC manages to break above this level.

BTC price tried to make a comeback on Saturday morning by jumping more than 3% over the last day. BTC is trading at an average price of $98,319 as of press time. Its 24-hour trading volume is down by 12% to stand at $89 billion.

Coinglass data shows that over $134 million worth of long and short bets set on BTC price were liquidated in the last 24 hours. Around $78.32 million worth of liquidated positions (58%) turned out to be long bets. This suggests that investors were hoping Bitcoin price would recover and keep moving toward the $100K mark, but Bitcoin price fluctuated enough to go against the bulls.

BTC ETFs bleeding

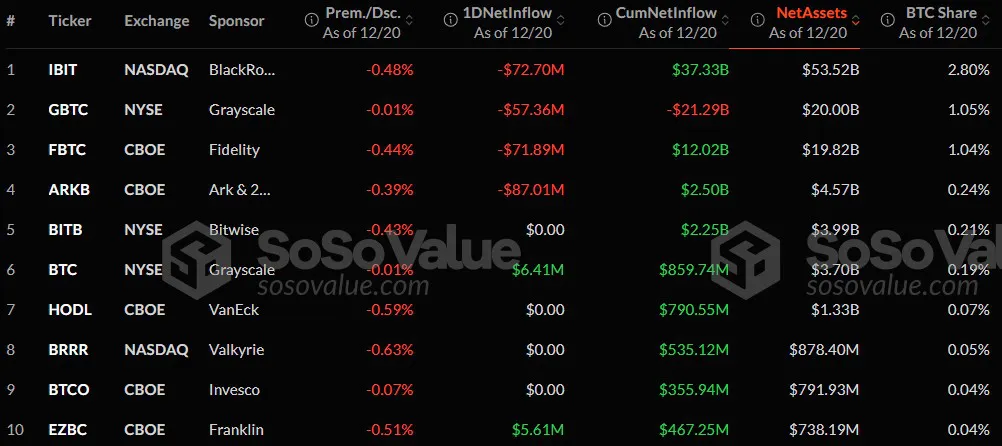

After setting a record high above $108,000 earlier this week, Bitcoin slid over 10% to hit a low of $92,200 area. Meanwhile, smaller tokens like Ethereum (ETH) and Dogecoin (DOGE) also felt the impact. Adding to the bearish sentiment, US Bitcoin ETFs posted a record outflow of $680 million on Thursday, which eventually ended a 15-day streak of continuous inflows.

The fresh data shows that Bitcoin spot ETFs are still bleeding, and the net outflow reached $277 million on Friday, December 20. Grayscale’s GBTC recorded a net outflow of $57.36 million bringing its total historical net outflow to $21.29 billion. Its Mini Trust ETF reported an inflow of $6.41 million. Franklin’s ETF EZBC registered a daily net inflow of $5.61 million to lead its total historical net inflow to reach $467.25 million.

The total net asset value of Bitcoin spot ETFs stands at $109.72 billion with the ETF net asset ratio (the market value relative to the total market value of Bitcoin) reaching 5.75%. The Federal Reserve’s hawkish stance is adding more pressure to the situation. With fewer rate cuts expected for 2025, investors are reassessing risk assets.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.