Amid the anticipation of Donald Trump’s inauguration last week and the flurry of activity that followed this week, U.S. spot Bitcoin ETFs have recorded a six-day inflow streak.

With President Donald Trump’s meme coin launch and recent executive orders to look into creating a national crypto stockpile, the crypto space has been awash with activity over the past week, allowing some key metrics to fly under the radar. For one, Bitcoin exchange-traded funds have had an incredible run over the last six days, culminating in record volumes in the past 24 hours.

Bitcoin ETFs Gobble up Nearly $4B, Volumes Break $10B

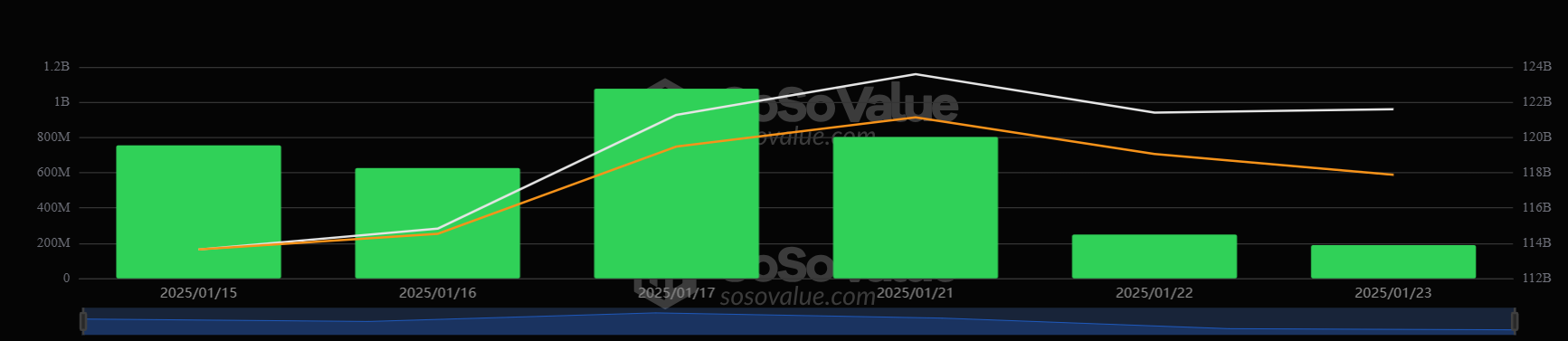

Specifically, these investment vehicles have raked in $3.7 billion in net inflows in the six trading days between January 15 and January 24, per SoSoValue data. This data includes the over $1 billion in net inflows recorded on Friday, January 17, and the over $800 million from Tuesday, January 21.

Reacting to data on Friday, January 24, ETF Store President Nate Geraci described the $3.7 billion figure as “ridiculous.”

While everything else is going on, spot bitcoin ETFs have quietly taken in $3.7bil over past 6 days…

*$3.7bil*

That’s a ridiculous number.

— Nate Geraci (@NateGeraci) January 24, 2025

Meanwhile, culminating this run, these ETFs traded over $10 billion in volumes for the first time since March 2024 on Thursday, January 23, per CoinGlass data.

New All-Time High Incoming?

The last time Bitcoin ETF volumes crossed $10 billion in a single trading day was March 6, 2024. This preceded a 17% run-up to new all-time highs near the $74,000 price point a week later.

Whether Bitcoin can replicate such a move will likely depend on the progress of Trump’s pro-crypto policy efforts and the outcome of next week’s Federal Open Market Committee meeting.

At the time of writing, however, the asset’s price continues to idle around the $105,000 price point, below its recently formed all-time high of $109,600.