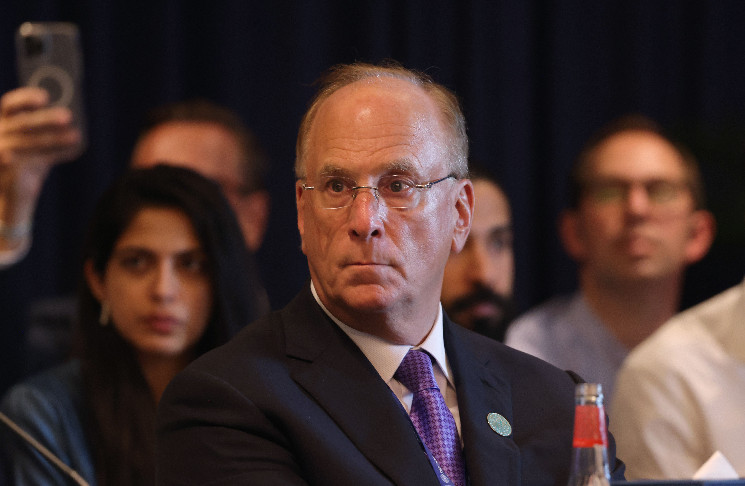

Still a big fan of digital assets, BlackRock CEO Larry Fink nevertheless said he\'s not blind to the possible risks to the U.S. from Bitcoin\'s (BTC) rise to prominence.

“The U.S. has benefited from the dollar serving as the world’s reserve currency for decades,\" said Fink in his annual letter to shareholders.But that’s not guaranteed to last forever … If the U.S. doesn’t get its debt under control, if deficits keep ballooning, America risks losing that position to digital assets like Bitcoin.”

\"I\'m obviously not anti-digital assets,\" Fink continued.\" But two things can be true at the same time: Decentralized finance is an extraordinary innovation. It makes markets faster, cheaper, and more transparent. Yet that same innovation could undermine America\'s economic advantage if investors begin seeing Bitcoin as a safer bet than the dollar.\"

Fink’s letter comes at a time of high market uncertainty and anxiety among investors about the economic state of the country amid policy changes set in place by U.S. President Donald Trump. To balance out the national deficit, Fink said, investors should diversify their portfolios to add private market assets in addition to stocks and bonds.

Doubling down on his commitment and belief in digital assets, Fink said he believes that tokenized funds will be as well-known among investors as exchange-traded funds (ETFs), provided that the industry can create a better infrastructure for digital identities, which Fink believes to be a hurdle in getting institutional investors from fully embracing decentralized finance.

“Every stock, every bond, every fund— every asset—can be tokenized. If they are, it will revolutionize investing,” he wrote. “ If we\'re serious about building an efficient and accessible financial system, championing tokenization alone won\'t suffice. We must solve digital verification, too.”

BlackRock, in January 2024, became one of the issuers to launch a spot bitcoin ETF. Their product, the iShares Bitcoin Trust (IBIT), became the most successful ETF in the history of the asset class. As of today, the fund handles nearly $50 billion in assets, with half of that coming from retail investors. The asset manager has also issued a tokenized money market fund, BUIDL, which is on track to cross $2 billion in assets by April, making it the largest tokenized fund currently on the market.