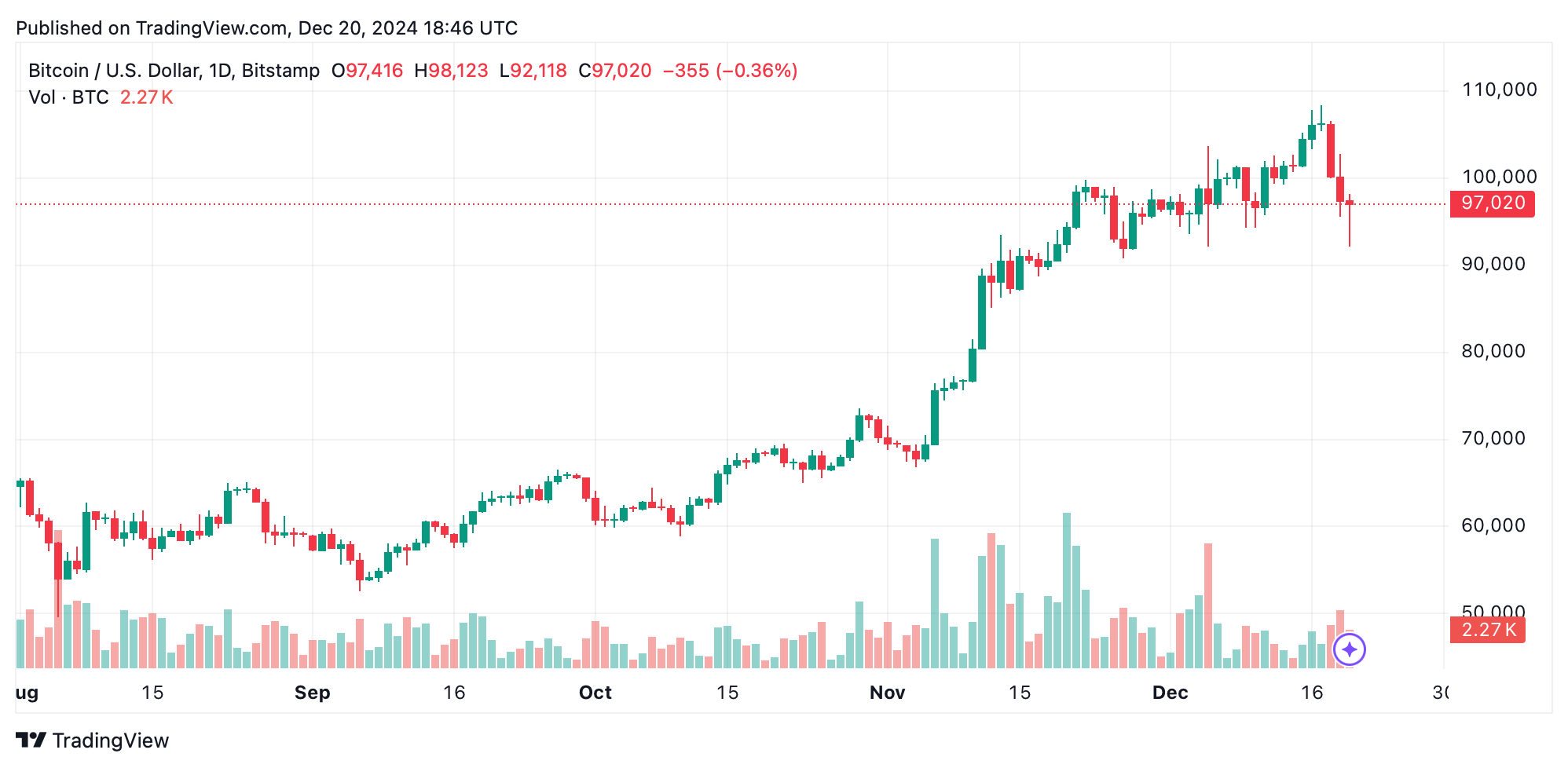

On Friday afternoon, crypto markets appeared to catch their breath, though traders remained on edge, bracing for bitcoin’s next twist. At press time, BTC was trading at $96,800 to $97,150 per coin, while the broader crypto economy stood at $3.34 trillion—down 2.7% after some recovery.

Bears Take a Breather

Despite recent turbulence, the crypto market seems to have stabilized, at least for now. Bitcoin (BTC) and ethereum (ETH) are down modestly by 1.4% and 1.3%, respectively, with BTC holding at $96,800 to $97,150 and ETH at $3,426 to $3,434. However, several altcoins are still nursing deeper losses. Curve DAO (CRV) is down 8%, optimism (OP) has slid 6.73%, and cronos (CRO) and uniswap (UNI) have each dipped by over 6%.

Just last week, the Crypto Fear and Greed Index (CFGI) was flashing “extreme greed.” Now, while still in the “greed” zone, the index reads a slightly more cautious score of 74 out of 100. Crypto data platforms indicate global market trading volume is approximately $345.23 billion, reflecting a 17.93% increase over the past day. Bitcoin maintains a 57.3% dominance, while ethereum holds 12.3% of the $3.34 trillion crypto economy.

Social media chatter is abuzz with the trending term “crypto dump,” with some users predicting further price declines before the dust settles. Others are hopeful historical patterns will come into play, anticipating a BTC rebound. One observer speculates, “the rebound pump could be UNBELIEVABLE for altcoins,” while a few optimists already see bullish signals on the horizon.

The crypto market’s delicate balance serves as a stark reminder of its unpredictable nature during bull markets. Similar patterns did occur in 2021 and 2017. Traders find themselves caught between cautious optimism and lingering apprehension. While some look to historical trends for reassurance, others acknowledge the possibility of uncharted territory ahead. The coming days may define whether this pause becomes a pivot point or a prelude to further volatility.

As emotions run high and speculation grows, market sentiment is as much a driver as data itself. This moment reveals the fine line between resilience and fragility within the crypto ecosystem. Whether future movements bring recovery or deeper corrections, one certainty remains: the crypto space never stays quiet for long, keeping traders alert and investors intrigued.