Bitcoin crossed $105K as the FOMC decided to maintain steady rates. Could this be a dovish catalyst to drive BTC price to a new all-time high?

The Federal Open Market Committee’s decision to keep federal rates between 4.25% and 4.5% is acting as a dovish catalyst for the crypto market. The total crypto market cap has increased by 2.87% over the past 24 hours, reaching $3.5 trillion.

Amid the recovering sentiment, Bitcoin surpassed the $105,000 mark, seeing a 3.15% surge over the last 24 hours. With improving conditions, bulls are anticipating a rally similar to the 2021 market.

Institutions Are Back for More Bitcoin

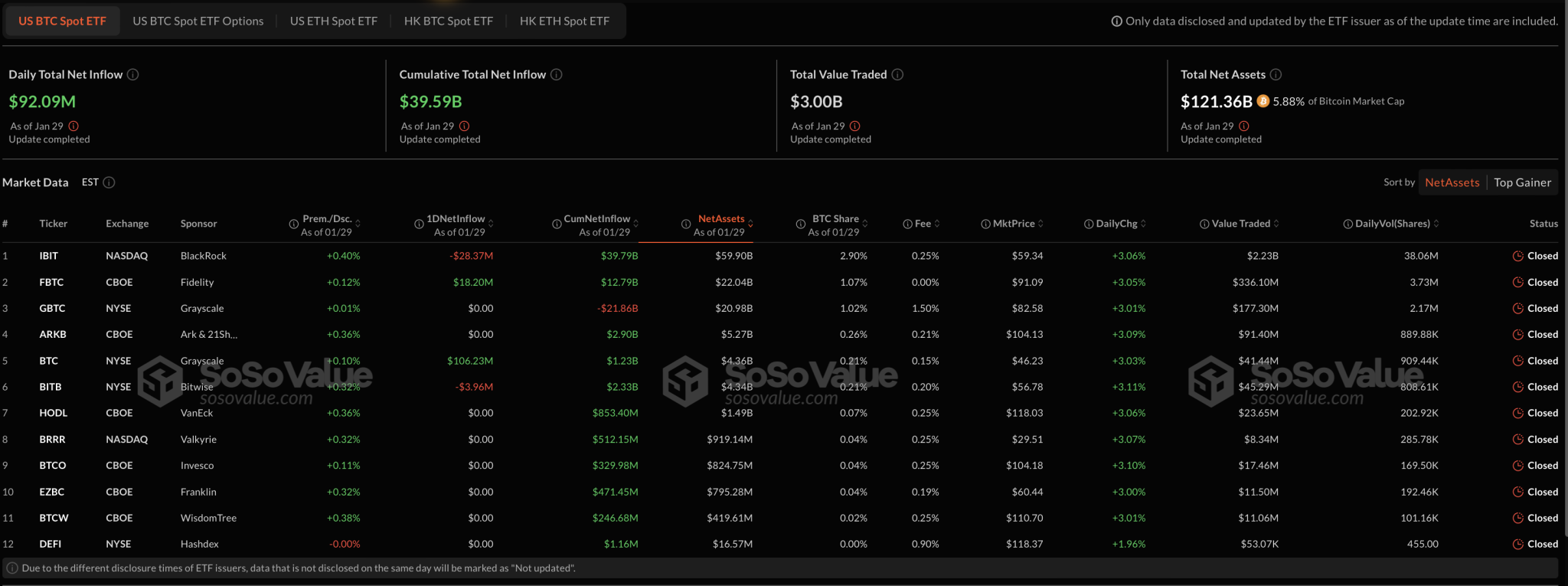

Institutional support for Bitcoin has resurged with the FOMC’s decision to keep rates steady. On January 29, the daily total net inflow into 12 U.S. spot Bitcoin ETFs reached $92.09 million.

Notably, this represents a significant recovery compared to the $457 million outflow on January 27.

Leading the bullish charge on January 29, Grayscale bought $106.23 million worth of Bitcoin. Additionally, Fidelity acquired $18.20 million in Bitcoin.

Among the sellers, Bitwise recorded an outflow of $3.96 million, while BlackRock, typically a major Bitcoin purchaser, offloaded $28.37 million in BTC.

In summary, the resurgence of institutional support, with a $92.09 million net inflow into Bitcoin ETFs on January 29, signals renewed investor confidence.

Speculations Spur as Market Recovers

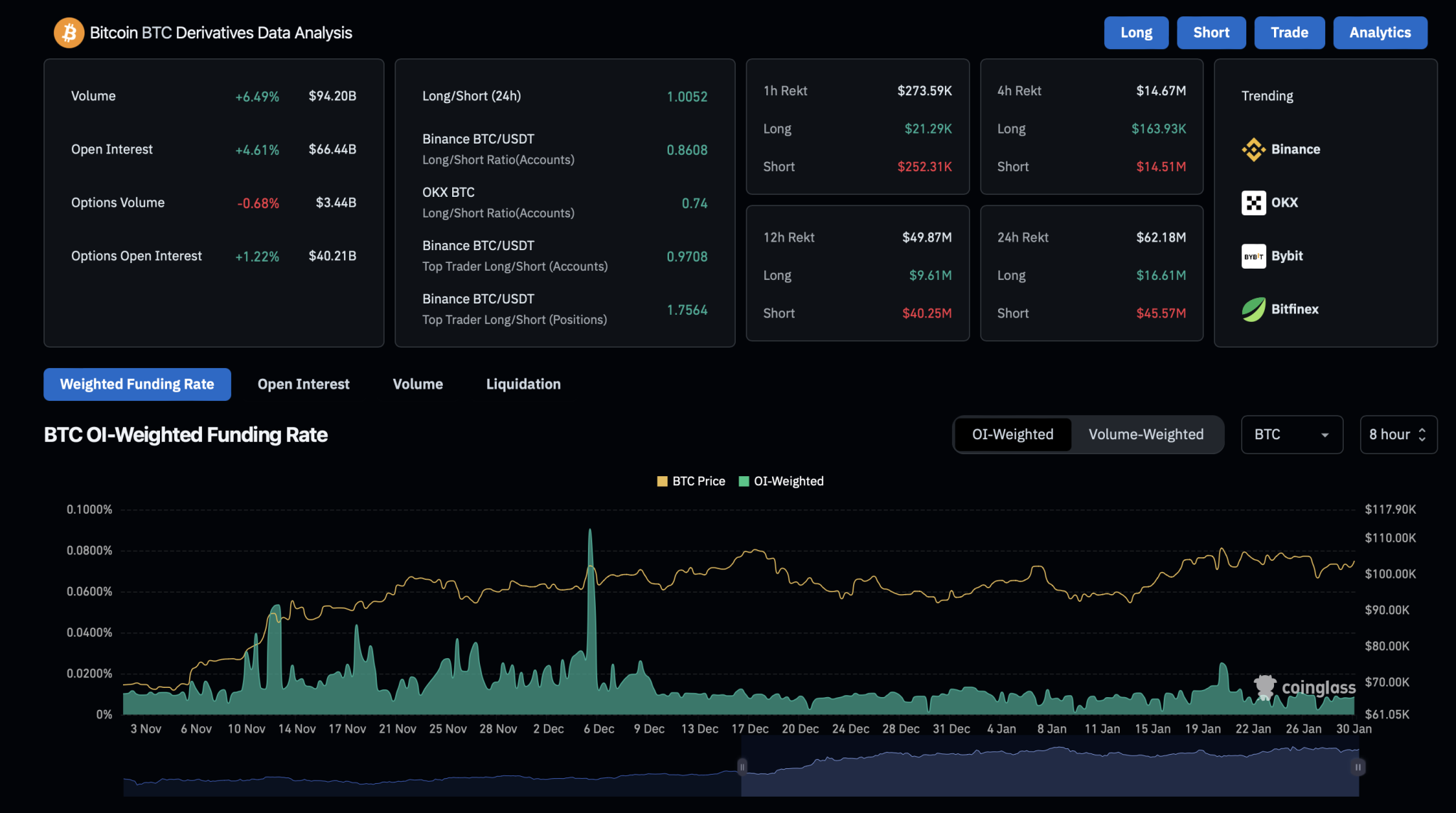

With the significant market recovery and rising anticipation of a 2021-style bull market, trader speculation is on the rise. Bitcoin’s open interest has increased by 4.43%, reaching $66.18 billion.

Additionally, the long-to-short ratio has shifted, now standing at 1.0092, a notable improvement compared to 0.96 the day before. Further, the funding rates remain steady at 0.0086%.

These key derivatives indicators suggest sustained trader confidence, supporting Bitcoin’s upside potential.

Bitcoin Analysis Targets $107k Resistance

On the 4-hour chart, BTC’s price action shows a strong reversal rally from the 50% Fibonacci level at $98,611. With a quick V-shaped reversal, the uptrend continues, crossing above the $105,000 mark.

Currently, Bitcoin is trading at $105,427, marking its fourth consecutive bullish candle on the 4-hour chart. The growing bullish influence has led to a positive crossover between the 20 and 50 EMA lines, signaling a return to bullish sentiment.

The RSI line has crossed above the halfway level and is approaching the overbought boundary, indicating rising bullish demand.

BTC Price Targets

Bitcoin is now nearing a crucial supply zone around the $107,000 resistance level. A breakout above this supply zone, between $107,000 and $108,000, could trigger an explosive rally.

The 1.272 and 1.618 Fibonacci levels provide two price targets: $112,000 and $118,666.

Meanwhile, a failure to sustain the ongoing rally could see Bitcoin retrace to the support levels between $103,393 and $100,557.