Prominent investment company Avenir has significantly increased its Bitcoin-related holdings, according to its latest 13F filing.

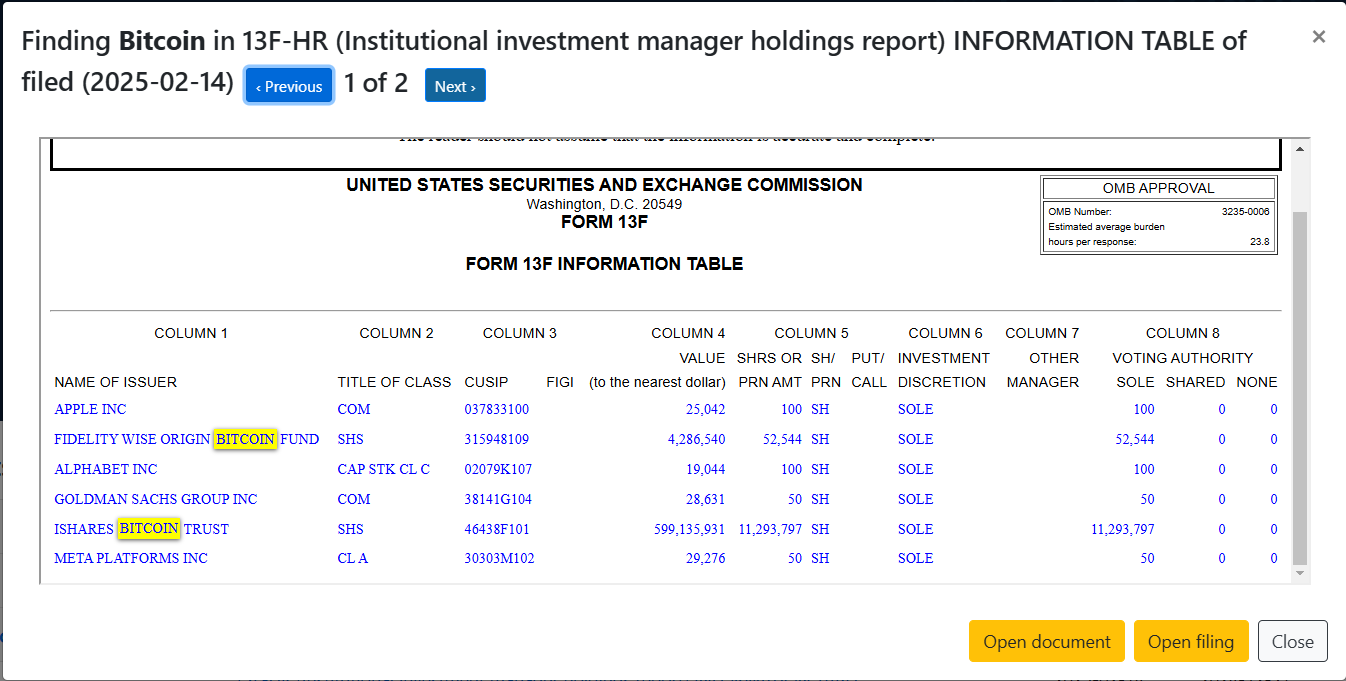

The firm reported owning $599 million worth of shares in BlackRock’s iShares Bitcoin Trust (IBIT) as of December 31. This reflects a substantial increase from the 614,195 shares it held in September, which were then valued at $22 million.

Additionally, Avenir disclosed a $4.2 million position in the Fidelity Wise Origin Bitcoin Fund (FBTC), holding 52,544 shares.

The 13F filing details institutional investment holdings, outlining asset positions, their CUSIP numbers, and market valuations. Avenir’s reported increase in Bitcoin ETF exposure aligns with IBIT’s rapid growth, which has outpaced other exchange-traded funds in historical performance.

BlackRock Bitcoin ETF’s Record Growth

BlackRock’s Bitcoin ETF has set a new record in the exchange-traded fund industry. Data indicate that IBIT has reached $56 billion in net assets under management.

Notably, the fund attained the $50 billion milestone in just 228 days, surpassing the previous fastest record of 1,329 days by a significant margin. Analysts highlight IBIT’s rapid ascent as a notable development in the crypto investment landscape, reflecting heightened institutional interest in Bitcoin exposure.

The strong performance of BlackRock’s Bitcoin spot product follows a broader trend of growing investor interest in regulated cryptocurrency investment vehicles. Avenir’s increased holdings underscore the firm’s strategic positioning within this market as Bitcoin ETFs continue gaining traction among institutional investors.

Avenir Group’s Growth Initiatives

The increase in Avenir’s Bitcoin ETF investments coincides with key industry developments led by Avenir CRYPTO, the firm’s digital asset division. The company recently organized its flagship Future Boundless event in Singapore, bringing together top industry leaders.

Co-hosted with Deribit, Paradigm, and LTP, the event addressed market challenges such as trading inefficiencies and liquidity fragmentation in the crypto sector.

This gathering follows the launch of Avenir CRYPTO’s $500 million Crypto Partnership Program, announced in September. The initiative aims to support quantitative trading teams and enhance financial innovation.

Notably, the program allocates 200 million USDT, 3,000 Bitcoin, and 50,000 Ethereum to strengthen partnerships with top-performing firms worldwide.