February will see a significant influx of nearly $900 million in vested tokens, with prominent projects such as Avalanche, Aptos, and The Sandbox leading the way.

Crypto vesting entails the process of locking digital assets for a predetermined period before holders can freely access or transfer them from their wallets. This strategy aims to deter early investors from hastily offloading their tokens for profit and encourages a sustained commitment to the project over the long term.

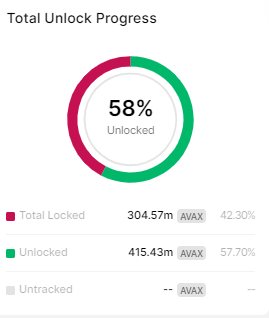

According to data compiled by Token Unlocks, Avalanche is set to unlock the largest volume of tokens on February 22. It plans to release 9.5 million tokens worth approximately $320 million as part of its proof-of-stake blockchain project.

The tokens will be used for the airdrop, strategic partnerships, and team members of the Avalanche Foundation.

Aptos, The Sandbox and More Follow Suit

Aptos, a Layer-1 blockchain, will release 24.8 million tokens on February 11, amounting to roughly $233 million. The distribution includes allocations for core contributors, investors, and community and foundation initiatives.

Similarly, The Sandbox will unlock 209 million tokens valued at around $90 million, with a portion reserved for company reserves and team and advisor allocations on February 14.

On February 29, Optimism is set to release 24 million OP tokens, valued at approximately $70 million, to its core contributors and investors. Meanwhile, Sui is unlocking $53 million in tokens for its community access program.

Market Implications

The sudden increase in the circulating supply of tokens can potentially impact cryptocurrency market prices. While some token unlocks may generate excitement and attract short-term investors, others may signal a more long-term investment outlook.

Before making an investment decision, investors should thoroughly assess a project\'s prospects and development trajectory.