A crypto strategist who nailed the pre-halving Bitcoin correction earlier this year is warning that BTC may head lower as resistance continues to strengthen.

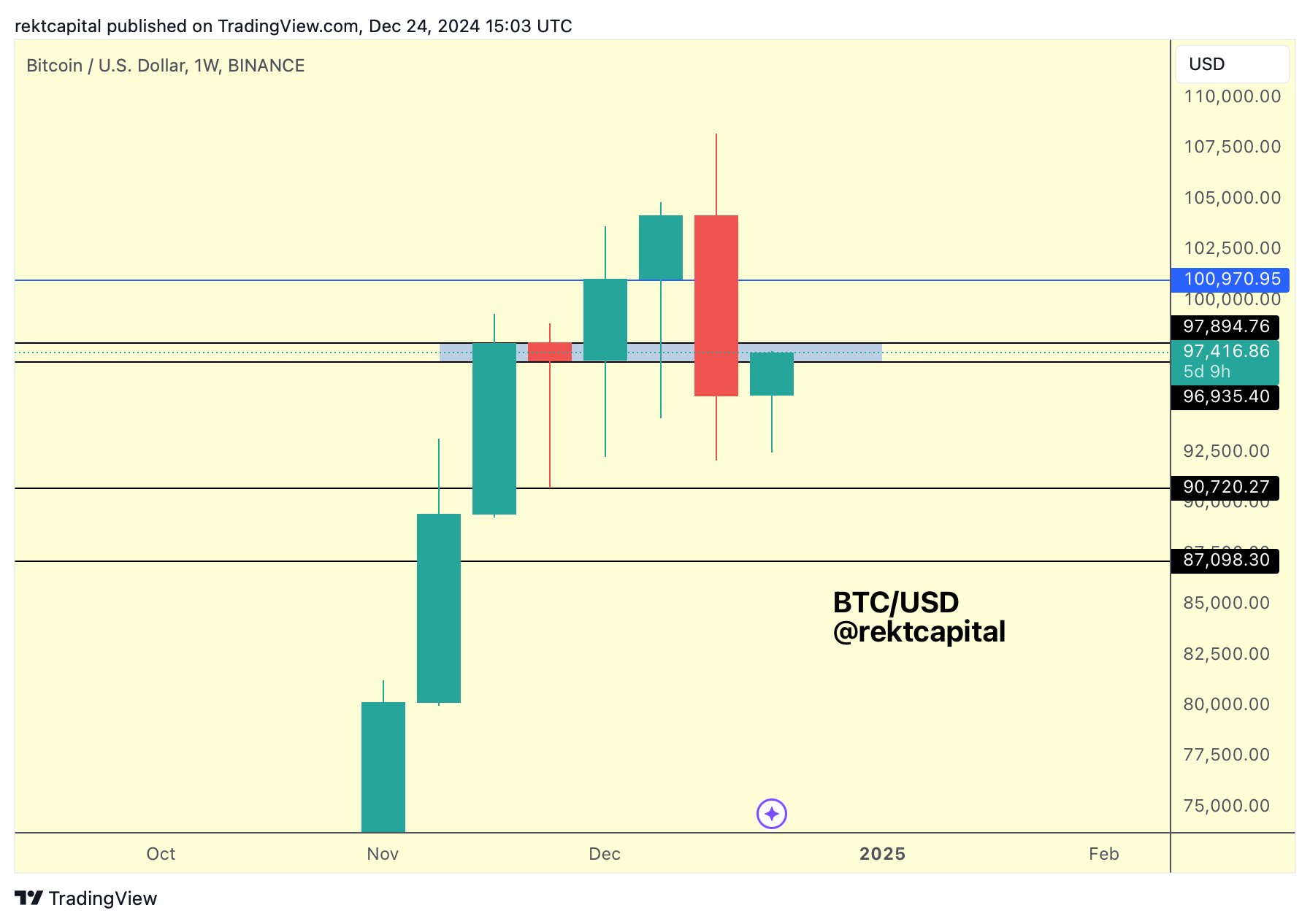

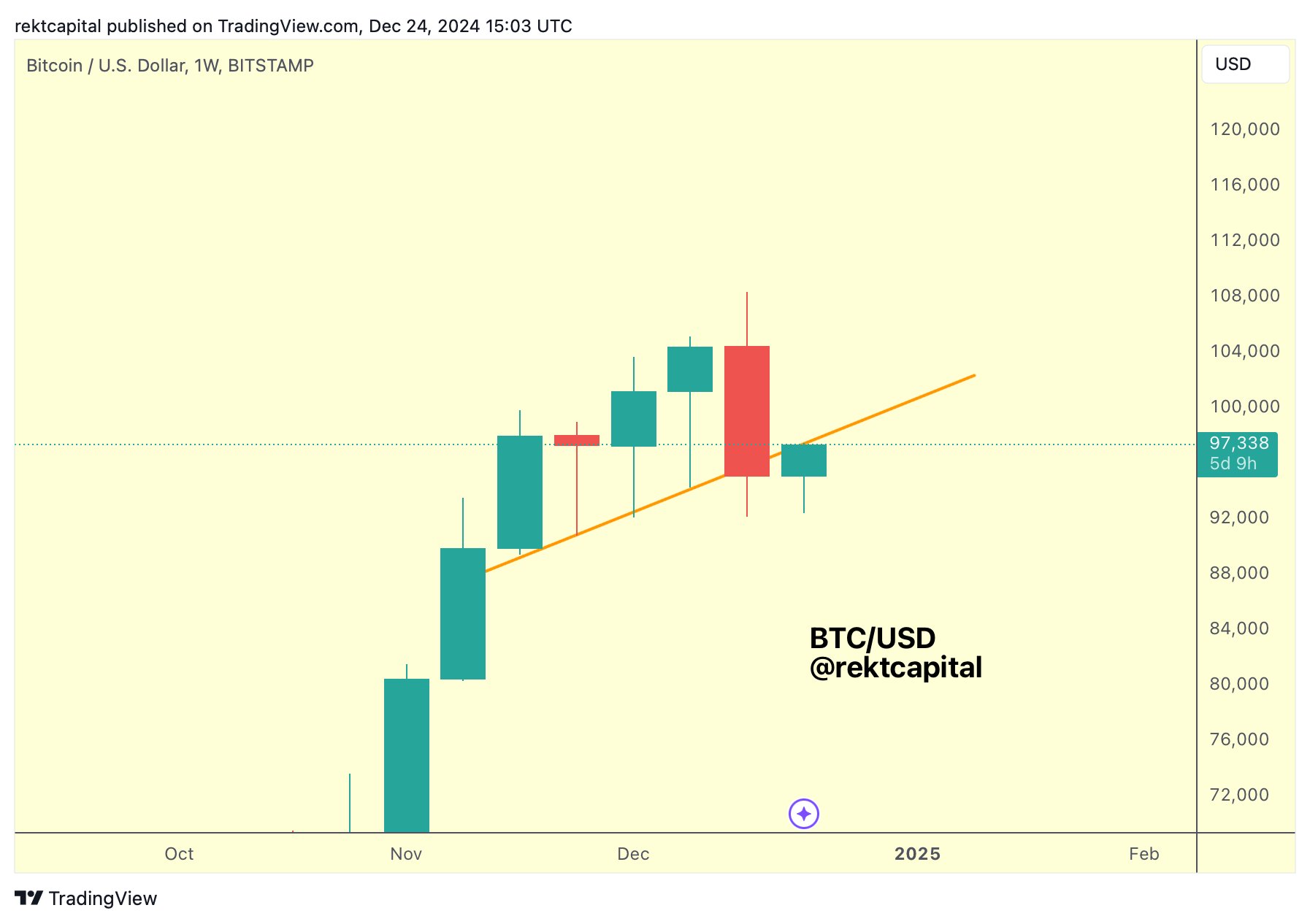

Pseudonymous analyst Rekt Capital tells his 523,400 followers on the social media platform X that Bitcoin is looking near-term bearish as it struggles to reclaim key support levels on the weekly chart while it chops around the $90,000 range.

“[Monday], Bitcoin showed some signs of a relief rally after which price was rejected to almost new lows. [Tuesday], Bitcoin [was] rebounding yet again and once again into the old support. Overall, as long as the previously lost supports turn into new resistance additional downside should be expected. Conversely, a reclaim of these previously lost supports would obviously be bullish.”

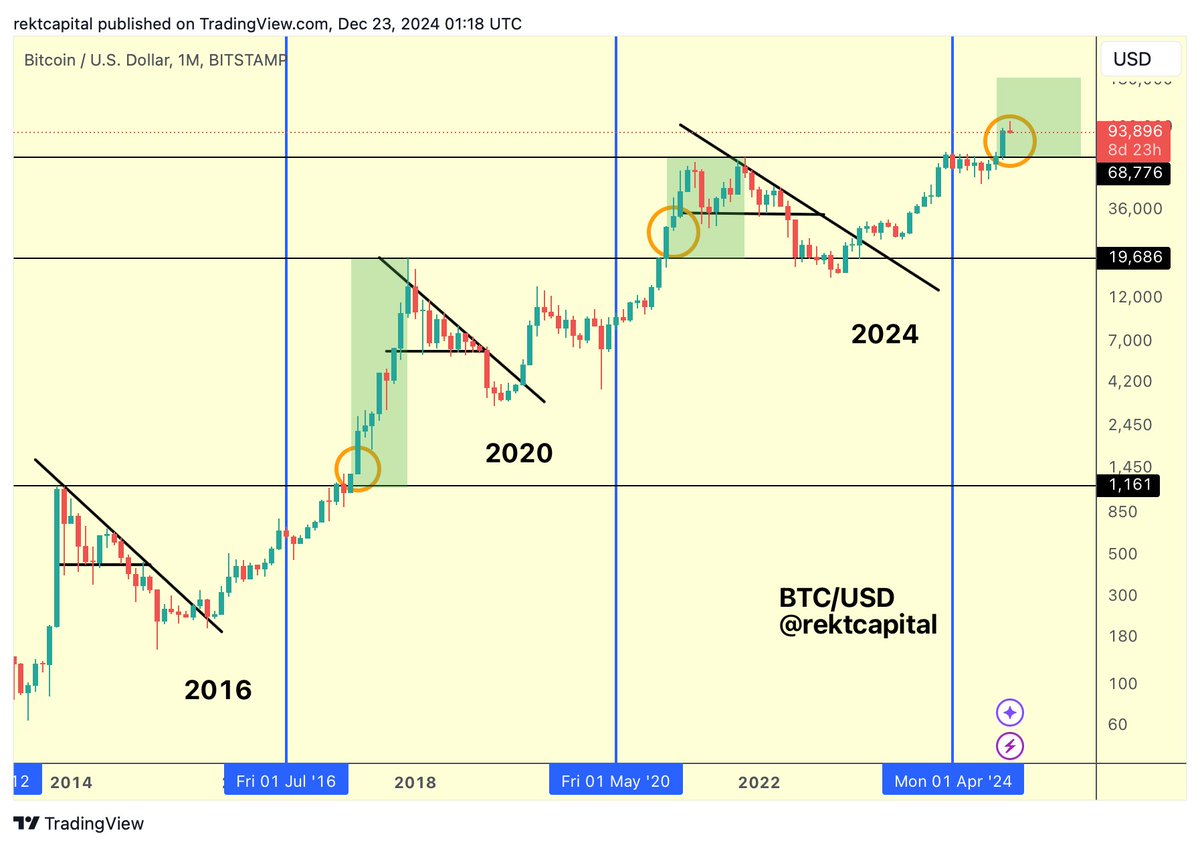

The analyst also says that a Bitcoin correction during these weeks of the current bull market cycle is not unusual based on historical precedence, and it could set the flagship crypto asset up for rallies.

“BTC is offering more confirmation for additional downside than reasons to be bullish for the moment. Once Bitcoin clears its historically corrective weeks seven, eight and nine in price discovery the opposite will be true. It’s Christmas and this retrace is a gift.”

Lastly, the analyst suggests that Bitcoin has about 38% left to complete in the bull market cycle based on previous cycles and that the final stage is traditionally the most explosive phase.

“Bitcoin bull market progress: 62%. (Progress will speed up in the parabolic phase).”

Bitcoin is trading for $98,151 at time of writing, up more than 125% in the last year.