Last week the crypto market didn’t just ride on bitcoin’s coattails—it ran with it. As bitcoin smashed through the $100,000 mark (again), ethereum, solana, and a host of altcoins followed suit.

This editorial is from last week’s edition of the Week in Review newsletter. Subscribe to the weekly newsletter to get the editorial the second it’s finished.

Last Week The Market Turned Green: Bitcoin Blasted Past $100K

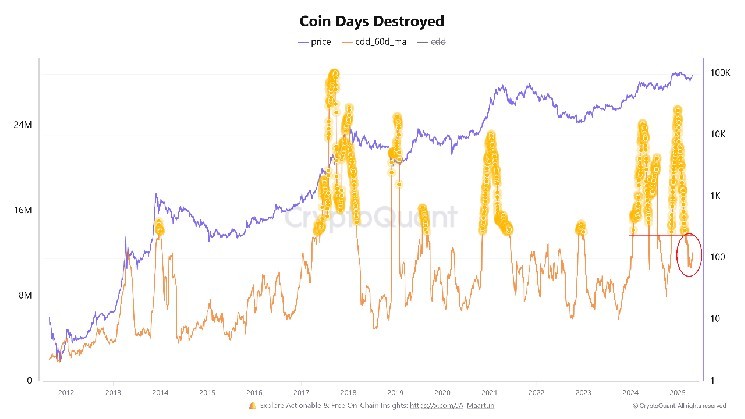

For the first time in months, the entire crypto market—not just bitcoin—had a good week. Of course, bitcoin led this week, breaking through the $100,000 barrier with alacrity. Every week, it seems more good bitcoin news appears, and this week was no exception. For the first time ever, not one, but two U.S. states—New Hampshire and Arizona—established strategic bitcoin reserves. They did so within 48 hours of each other. Metaplanet added 555 BTC to its treasury, bringing its overall holdings to 5,555, with ambitious plans to reach a total of 21,000 by the end of next year. Those inflows, combined with positive spot‑ETF flows, propelled BTC above $100K.

It marked bitcoin’s eighth intraday trip above six figures, and the eighth consecutive instance in which ETH’s price at the time bitcoin hit $100K was lower than before, as depressingly pointed out here and illustrated by the following graph.

But even the cursed coin that is ethereum benefited from the positive sentiment this week, going up more than 20% in the past seven days. It’s even better when compared to bitcoin’s 3.3% over the same time period. Ethereum even managed to beat solana’s 14.5%. Spot ether ETF flows look half-decent, according to Bloomberg’s James Seyffart, who posted on X that “Everyone likes to Pile onto Ether but the ETFs are doing decently well as far as flows go. The problem is that assets are lower now than when they launched.” For the last bit of ethereum hopium, Raoul Pal founder of Real Vision stated that “ BTC dominance topped today.” If that’s the case, surely ETH/ BTC has finally bottomed!

I personally don’t think this is the bottom of the ETH/ BTC chart. Graham and I went back-and-forth about this topic on this week’s episode of Token Narratives. The chances that we are on the cusp of a bitcoin breakout grows higher as we approach a new bitcoin all-time high. With so many tailwinds for bitcoin right now, such as the stream of positive news stories (institutions are buying, companies are buying, governments are buying) and strong narratives (it’s a hedge against fiat debasement, it’s a hedge against geopolitical conflict, everyone is buying), a bitcoin rally is more likely than not.

Historically, when bitcoin goes on a tear, bitcoin dominance surges too. Bitcoin sucks up the liquidity and attention from everything else. The BTC.D (Bitcoin dominance) chart looks like it could easily reach the low 70s before it tops, similar to 2019 and 2021. It’s at 64% now. We could see it rise another 10% before bitcoin finally cools off. At that point it makes sense for profit taking, some of which would be rolled over into the rest of crypto. A bona fide alt season could be in the cards at that point. One can dream!

For the time being, I’m happy to sit on my hands, but I am starting to take notes of interesting projects. My interview with Jordi Alexander left a strong impression on me, particularly his comments about A.I. While he is excited about the A.I. x crypto sector, he’s only excited about agentic A.I. projects. I’ve heard this sentiment echoed by many people across several conferences.